BP and Phillips 66 Rally on Earnings – Which Is the Better Buy? Dear Reader, 2023 was a phenomenal year for the stock market. The S&P 500 rallied more than 26%, the Dow climbed up about 13.7%, while the tech-heavy NASDAQ surged 43%.

In comparison, the energy sector declined 1.33%, according to U.S. Wealth Management. Not only did the sector significantly underperform the S&P 500, Dow and NASDAQ, but it also fell short of its strong performances in 2022 and 2021, where it gained almost 66% and 55%, respectively.

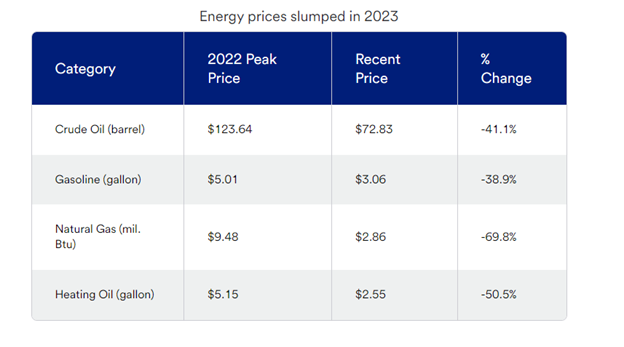

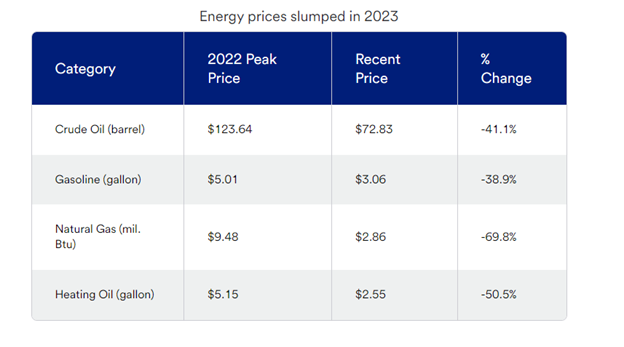

The reality is 2023 ended up being a bad year for energy prices, which spooked investors and caused them to rotate out of energy stocks. As you can see in the chart below, they all fell significantly from their 2022 highs.  Source: U.S. Wealth Management So far this year, crude oil prices are rising, up about 6.9% year-to-date and currently at about $76 per barrel. But I think prices could climb much higher from current levels.

Here’s why…

Now, there are currently a handful of global factors at play that are directly impacting the energy sector. Chaos in the Middle East, disrupted shipping lanes, crude oil shipments and production could be disrupted in the coming months.

Additionally, after Ukraine bombed Russia’s natural gas pipeline and the Trans-Siberian Railway, there is still the looming threat that Russia’s crude oil pipeline could be bombed.

Ukraine’s latest major attack was a chemical transport facility with drones last week. Specifically, the Ust-Luga port was on fire, which is about 100 miles southwest of St. Petersburg. This port is a crucial location for Russia energy infrastructure and operated by Novatek, Russia’s second-largest natural gas producer.

Any one of these factors could send crude oil prices soaring. So, do not be surprised if during the next flareup in the Middle East, crude oil prices hit $80 per barrel.

Being that I remain bullish on energy, you can bet I’ve been following energy companies’ earnings results very closely. We've heard from a slew of energy companies in the past few weeks, including well-known energy players like BP p.l.c. (BP), Chevron Corporation (CVX), Exxon Mobil Corporation (XOM), Marathon Petroleum Corporation (MPC) and Phillps 66 (PSX). All rallied in the wake of their earnings results.

In today’s Market 360, I want us to focus our attention on BP’s and Phillips 66’s earnings. We’ll take a closer look at their quarterly reports, and I’ll share which one is the better buy that should continue to reward investors. And then, I’ll show you where to find the earnings winners this earnings season.

Let’s jump in. BP Reports Weak Q4 Earnings BP reported earnings for the fourth quarter 2023 on Tuesday, February 7. The company posted earnings of $1.07 per share on revenue of $51.14 billion, missing analysts’ earnings estimates by 1.8% and revenue estimates by 8.7%.

But the real news was about BP’s profits. Profits came in at $3 billion in the fourth quarter and were $13.8 billion in 2023. This is down from profits of $27.7 billion in 2022, a new record for the company. However, this was still the highest profit the company has seen in a decade.

In the company’s press release, Chief Executive Officer, Murray Auchincloss, stated: Looking back, 2023 was a year of strong operational performance with real momentum in delivery right across the business. And as we look ahead, our destination remains unchanged – from IOC to IEC – focused on growing the value of bp. BP also increased its dividend by 10% to $7.27 per share. It also announced an increase to its share buyback plan for the first quarter. The company will repurchase $1.75 billion of its own stock in the first quarter, and restated its commitment to buying back $3.5 billion in the first half of 2024.

Luckily for BP, investors were so distracted by the shiny new dividend and profits that they ignored the weak earnings and revenue results. As a result, shares of BP spiked 6% on Tuesday and are now up about 3% year-to-date. Phillips 66 Beats on the Top and Bottom Lines Phillips 66 released better-than-expected quarterly and yearly results before the stock market opened on Wednesday, January 31. For the fourth quarter, Phillips 66 reported adjusted earnings of $1.36 billion, or $3.09 per share, compared to $1.9 billion, or $4.00 per share, in the same quarter a year ago. The analyst community expected adjusted earnings of $2.34 per share, so Phillips 66 topped estimates by 32.1%.

Phillips 66 also announced a return of $1.6 billion to shareholders throughout dividends and share repurchases during the fourth quarter. The company announced a quarterly increase of 8% to its dividend, and investors can now expect a dividend of $1.05 per common share.

President and CEO, Mark Lashier, stated: As we look forward, we will continue to execute our strategic priorities to deliver significant shareholder value. During 2023, we distributed well over 50% of our operating cash flow to shareholders through dividends and share repurchases. We have distributed $8.3 billion to shareholders since July 2022, on pace to achieve our $13 billion to $15 billion target by year-end 2024. The company also announced full-year adjusted earnings of $7.16 billion, or $15.81 per share, which compared to $8.9 billion, or $18.79 per share, in 2022. Analysts’ forecasts called for full-year adjusted earnings of $15.11 per share.

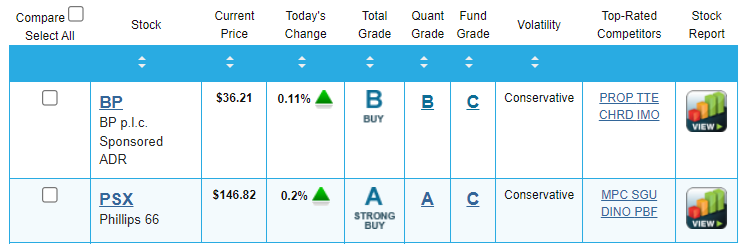

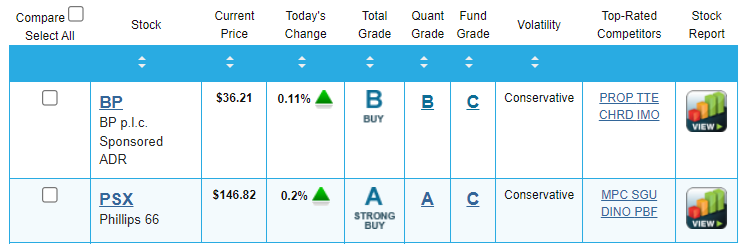

Shares of PSX rallied notched new 52-week highs and are now up around 10% year-to-date. The Better Energy Buy Is… Investors may have been comfortable paying no attention to the earnings behind the curtain, but not Portfolio Grader. I plugged both names into my Portfolio Grader, and one is the clear winner…

Phillps 66 not only has an A-rating overall making it a “Strong Buy”, but it also holds an A-rating for its Quantitative grade. This shows that the stock has strong institutional buying pressure – in other words, momentum – which is one of the key things to look for when picking a stock for my Accelerated Profits Buy List.

It’s also been a better performer over the longer term. Since mid-November 2022, Phillps 66 is up about 40%, while BP only rose about 12%. For perspective, the S&P 500 rallied by about 27%. So, not only did Phillips 66 nearly quadruple BP’s performance, but it also beat the S&P 500%. You can see for yourself in the chart below…  The bottom line: Phillips 66 is the better energy company. It has superior fundamentals, is backed by persistent institutional buying pressure and is a strong performer.

Now, those following my Accelerated Profits service already know this. I recommended this stock in November 2022. In fact, my Buy List is chock-full of fundamentally superior stocks like Phillips 66. Currently, my current Buy List is characterized by 36.8% average forecasted sales growth and 204.6% average forecasted earnings growth. And the stocks on my Buy List have also benefited from positive analyst revisions.

Our Accelerated Profits Buy List stocks are the crème de la crème – the stocks that are primed to post strong earnings results. If you join me at Accelerated Profits, you’ll get immediate access to my Buy List today. Not only that, but you will also get access to my Monthly Issues, Weekly Updates, Special Market Podcasts – and much more.

Click here to sign up for Accelerated Profits now.

(Already an Accelerated Profits member? Go here to log in to the members-only website.) Sincerely, |

.png)

.png)

No comments:

Post a Comment