The Secret to Spotting Earnings Moves Ahead of the Market | Editor’s Note: Tomorrow, January 9, at 8 p.m. Eastern time, I will be sitting down with Landon Swan for a special event: The A.I. Earnings Predictor Summit. (Click here to register for the event now.) But ahead of the event, I want to pass along an interesting article by his brother, Andy, where he explains how their proprietary system – LikeFolio – can help investors make informed trades during earnings season. Take it away, Andy! | | | Hello, Reader. During the 1980 Olympics, the U.S. hockey team pulled out a “Miracle on Ice” to bring home the gold against all odds.

They were outshot 39-16 and down 3-2. The game was all but decided. Until something changed – and the U.S. team rallied back in the third period to win 4-3 over the Soviet Union.

As team captain Mike Eruzione described the victory, "Once we got momentum, we just kept rolling. It's like a snowball effect."

Turns out, that “miracle” was actually momentum.

The noise level of the crowd rises, your heart races, beads of sweat form on your forehead, and your legs bounce you out of your seat.

Momentum is palpable – and powerful enough to completely alter an outcome.

Now, imagine you could apply that same type of momentum to investing and trading – to see the energy unfolding in real time, positive or negative, for publicly traded companies…

And leverage that momentum to make winning trades.

Well, you don’t have to imagine when you have Earnings Season Pass in your corner.

Our social media machine was designed to measure changes in key consumer metrics like buzz, demand, and sentiment, to quantify company-level momentum.

Researchers at Georgetown University referred to this as the “unexpected component of sales growth” when they confirmed the efficacy of our system.

During earnings season, investors can spot momentum and make informed trades by referencing a company’s Earnings Score, which is LikeFolio’s proprietary consumer momentum indicator.

The higher the score, the more bullish the outlook; the lower the score, the more bearish the outlook.

This method is simple, quantifiable, and increasingly predictive. Here’s how it works..

The LikeFolio Earnings Score Explained The LikeFolio Earnings Score is calculated from an ever-evolving equation that uses several inputs: - Consumer mentions growth and rate of change

- Consumer demand growth and rate of change

- Consumer sentiment and change over time

- Supporting macro trend growth and rate of change

- Custom company or brand-specific metrics and their growth or change over time

- Stock price performance as an indicator of investor expectations

Then, the results show us how bullish or bearish we are on a given company heading into earnings.

Scores will range from -100 to +100, with negative numbers being a bearish indication and positive numbers being a bullish indication.

The larger the number, the stronger the indication.

And the proof is in the profits… How We Nabbed an 80% Win in Just One Day Take a look at how our Earnings Score helped us bank a big win in just one day on Dick’s Sporting Goods (DKS) in November – because we'll use it again and again for hundreds of trading opportunities during the 10 weeks of each upcoming earnings season.

This particular trade setup hit during Week 6 of the Q4 season – just before Thanksgiving. Our AI-powered consumer insights machine assigned DKS an Earnings Score of +45, telling us the stock could surprise to the upside.

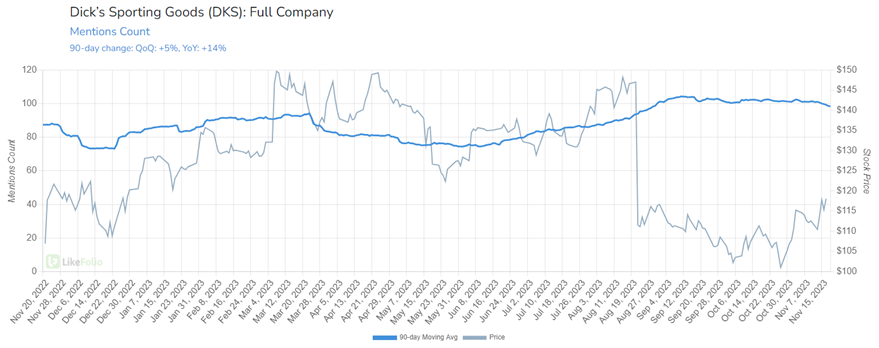

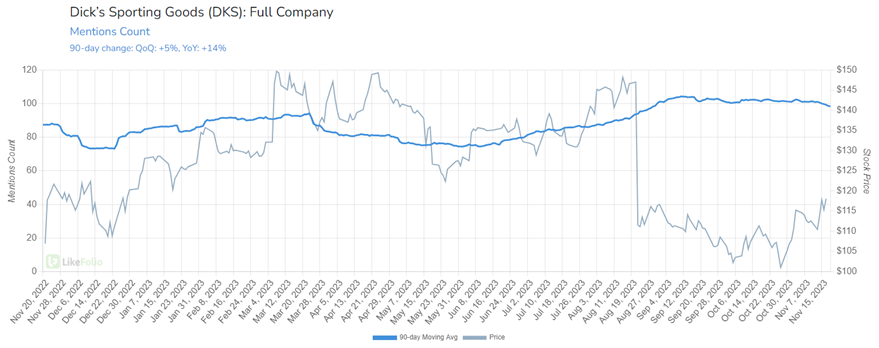

The company had recently opened a string of new “House of Sport” experience megastores, decked out with batting cages, rock walls, golf simulators – all sorts of hands-on areas where customers can demo products. And a deeper dive into our social data revealed they were generating renewed excitement from consumers.  In fact, LikeFolio data showed demand mentions for Dick’s hit a two-year high, while Consumer Happiness remained steady:

On the trend side of things, consumer interest in playing sports was (and still is) up, with pickleball mentions in particular gaining as much as 180% year-over-year. That worked in Dick’s favor.

Remember that our social media machine also takes into account investor expectations; and following Dick’s last earnings report, shares tanked over 24%, giving it a low bar to surpass.

All signs pointed to a bullish outcome. So on Monday, November 20, we leveraged one of our favorite trading strategies – one with a risk-reward ratio close to 50/50 that’s super simple to understand. Basically, you make money if the stock goes up and lose money if it goes down – but you cap your losses going in so you always know what’s at stake.

The very next day, Dick’s issued an impressive earnings report, featuring a record $3.04 billion in sales for the third quarter with an updated full-year outlook. It was the “best case” scenario.

DKS got a near-10% boost on the results, so we issued an early exit alert that netted investors an 80% profit.

In short, our social media machine tipped us off that Dick’s was gaining momentum, and we used that to deliver our subscribers an 80% win virtually overnight.

That’s why it helps to have a real-time performance checker in your investing toolkit.

We're gearing up for another action-packed 10 weeks of earnings to kick off this month.

Join us in Q1 of 2024 to get in on all the action.

Until next time, |

.png)

.png)

No comments:

Post a Comment