The 2 Biggest Winners and Losers of Earnings Season So Far... Dear Reader, We may not be in the heart of the fourth-quarter earnings season just yet (earnings results will start to come in fast and furious next week). But we were still treated to results from four well-known companies this week.

I’m talking about Netflix, Inc. (NFLX), Tesla, Inc. (TSLA), International Business Machines Corporation (IBM) and Intel Corporation (INTC).

Each rolled out their latest quarterly results… and they all made big post-earnings moves in the wake of their reports. Two rallied more than 10%, while two fell more than 10%.

So, in today’s Market 360 , we’ll review their quarterly results. We’ll consider what caused the stocks to climb higher or move lower. In addition, I’ll share the reports to watch next week, as they could have a big impact on broader market direction. Then, I’ll share how you can best prepare for earnings season.

Let’s start with Netflix’s earnings. Netflix Reports Q4 Earnings on January 23 Netflix released its fourth-quarter results Tuesday afternoon. The streaming giant announced earnings of $2.11 per share on revenue of $8.83 million. This compares to earnings of $0.12 per share and revenue of $7.85 billion in the same quarter a year ago. Analysts were calling for earnings of $2.22 per share and revenue of $8.72 billion, so Netflix missed earnings estimates but topped revenue estimates.

But more importantly, the company revealed that it added 13.1 million subscribers in the fourth quarter, up from 7.7 million in the same quarter of last year. This was substantially higher than projections of 8 million to 9 million. Netflix also announced that it is adding the WWE Raw program to its lineup in 2025, which should further help to broaden its subscriber base.

Looking ahead to the first quarter of 2024, Netflix anticipates earnings of $4.49 per share and revenue of $9.24 billion. The company also raised its full-year 2024 margin forecast to 24%, up from its previous forecast for 22% to 23%.

Shares of Netflix surged more than 13% on Wednesday to a new two-year high. Tesla Reports Q4 Earnings on January 24 Tesla reported its fourth-quarter earnings results Wednesday afternoon, and as I discussed in Thursday’s Market 360, the numbers left a lot to be desired. Earnings came in at $0.71 per share, which missed analysts’ estimates for $0.74 per share. That’s also down from $1.19 per share in the same quarter a year ago. Revenue rose nearly 3.5% year-over-year to $25.17 billion, up from $24.32 billion a year ago. Analysts were expecting $25.7 billion.

Due to price cuts, Tesla’s gross operating margins continued to shrink to 17.6%, which was below analysts’ estimate for 18.3%. The electric vehicle maker’s guidance was lackluster. It warned that its production growth rate would be “notably lower” than in 2023. It did not provide a specific estimate for 2024 sales due to interest rate uncertainty impacting vehicle sales.

Following the disappointing earnings results and soft forward-looking guidance, shares of Tesla plummeted more than 12% on Thursday. IBM Reports Q4 Earnings on January 24 IBM also shared its fourth-quarter earnings report Wednesday evening. The “Big Blue” tech company reported earnings of $3.87 per share on revenue of $17.38 billion, up from earnings of $3.60 per share and revenue of $16.69 billion in the same quarter a year ago. The analyst community projected earnings of $3.78 per share and revenue of $17.28 billion, so IBM posted a 2.4% earnings surprise and slight revenue surprise.

In the earnings press release, Arvind Krishna, IBM chairman and CEO noted, “Client demand for AI is accelerating and our book of business for watsonx and generative AI doubled from the third to the fourth quarter … Based on the strength of our portfolio and demonstrated track record of innovation, for 2024 we expect revenue performance in line with our mid-single digit model and about $12 billion in free cash flow.”

Shares of IBM jumped more than 10% to $196.90 on Thursday – a level they have not seen since June 2013. Intel Reports Q4 Earnings on January 25 Intel released a mixed fourth-quarter earnings report Thursday afternoon. Earnings per share tallied in at $0.54, while revenue was $15.4 billion. That’s up from earnings per share of $0.54 and revenue of $14 billion, or 260% year-over-year earnings growth and 10% year-over-year revenue growth. Analysts were anticipating earnings per share of $0.45 and revenue of $15.15 billion, so Intel beat earnings estimates by 20% and revenue estimates by 1.7%.

However, Intel’s first-quarter guidance was bleak. It projected earnings of $0.13 per share and revenue between $12.2 billion and $13.2 billion. This was well below analysts’ estimates for earnings of $0.33 per share and revenue of $14.15 billion. Ouch!

And during the earnings call, Intel CEO David Zinser was not very optimistic about its data center revenue growth in the first quarter. He said, “We expect Q1 data center revenue to decline double-digit percent sequentially before improving through the year.” Zinser also noted that “the data center has seen some wallet share shift between CPU and accelerators over the last several quarters.”

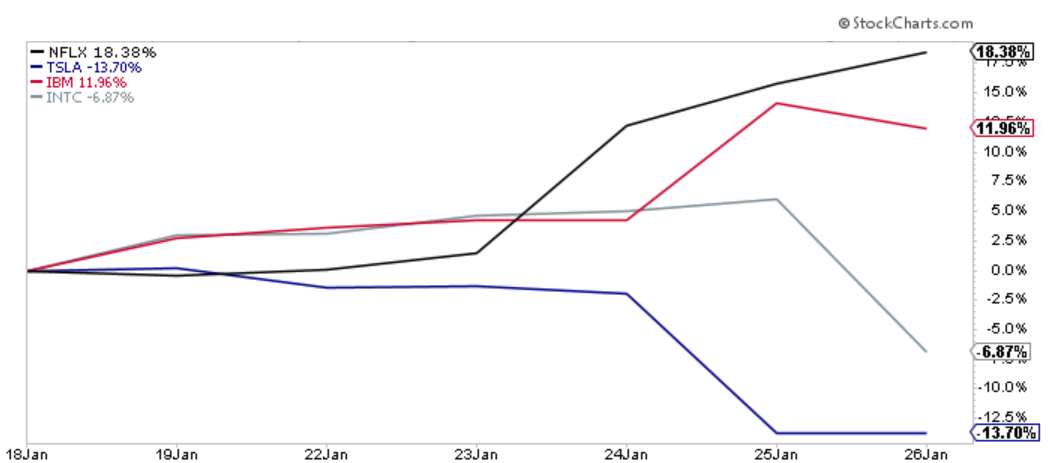

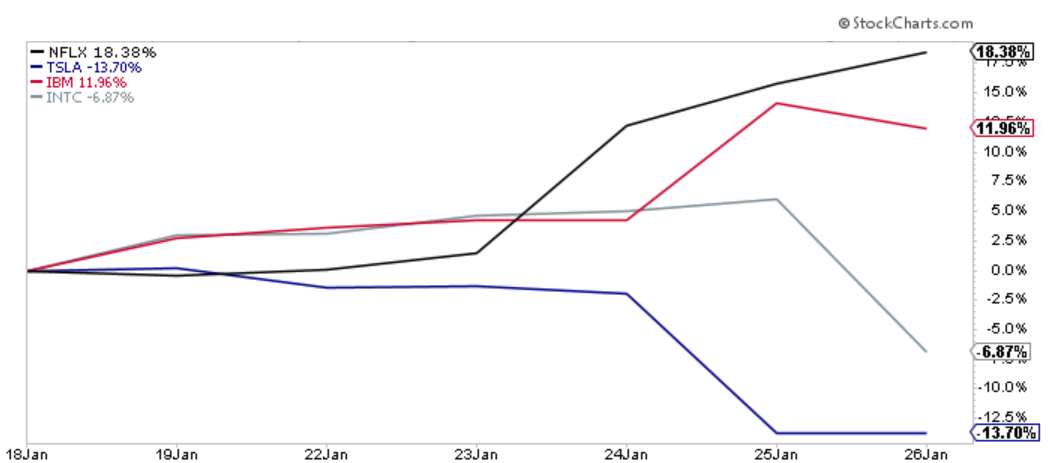

Wall Street was not happy with Intel’s disappointing first-quarter outlook and triggered a more than 10% drop in Intel shares today. Every Stock for Itself The fact of the matter is it’s every stock for itself right now. Companies that guide higher or post earnings beats, like Netflix and IBM, are rewarded. And the stocks (even the big ones) that post weak earnings and/or soft guidance are hit, which we saw with Tesla and Intel. You can see what this looks like in the chart below…  I should also add that these stocks’ post-earnings performance moved the markets. Netflix’s rally helped boost the S&P 500 to a new record high on Wednesday. IBM’s jump helped lift the Dow and S&P 500 on Thursday, while Intel’s fall today weighed on the S&P 500 and tech-heavy NASDAQ.

But with the earnings season set to heat up next week… we could be in for even bigger market swings. Magnificent 7 Stocks Up to Bat The reality is we enter the heart of earnings season next week, with a slew of earnings reports set to be released. This includes five of the “Magnificent 7” – Amazon.com, Inc. (AMZN), Apple Inc. (AAPL), Alphabet, Inc. (GOOG), Microsoft Corporation (MSFT) and Meta Platforms, Inc. (META). Tesla and NVIDIA Corporation (NVDA) round out the list, but, as you know, Tesla reported this week. NVIDIA is scheduled to report its latest earnings results on Wednesday, February 21.

These stocks were dubbed the Magnificent 7 after posting stunning gains (fueled by the artificial intelligence frenzy) in the first half of 2023. The S&P 500 had soared 15.9% – these stocks accounted for 73% of those gains. NVDA and META were also two of the S&P 500’s best performers last year, gaining 238.9% and 194.1%, respectively.

This year, the stocks account for about 28% of the S&P 500, so their earnings could significantly impact the broader market next week.

I should also add that the analyst community’s expectations are very high… - AAPL: 11.7% year-over-year earnings growth and a 3.1% year-over-year decline in revenue. Earnings estimates have stayed flat over the past three months.

- AMZN: 2,566.7% year-over-year earnings growth and 11.4% year-over-year revenue growth. Earnings estimates have been revised 21.1% higher in the past three months.

- GOOG: 51.4% year-over-year earnings growth and 12.1% year-over-year revenue growth. Earnings estimates are flat over the past three months.

- META: 180.1% year-over-year earnings growth and 21.5% year-over-year revenue growth. Earnings estimates have been revised slightly higher over the past three months.

- MSFT: 19.8% year-over-year earnings growth and 15.8% year-over-year revenue growth. Earnings estimates have been upped slightly in the past three months.

Why I’m Excited for My Growth Investor Stocks While I will certainly be keeping a close eye on their earnings results, I’m also very excited for what my Growth Investor stocks report. My stocks look good (I saw a lot of green on my screen on today!), and I expect them to post wave-after-wave of positive earnings in the upcoming weeks.

Currently, my Growth Investor stocks are characterized by 14.3% annual sales growth, 166.5% annual earnings growth, an 8.5% earnings surprise and a median fiscal 2024 price-to-earnings ratio of 16.7. So, my Growth Investor stocks are set up for success this earnings season.

To further position my Growth Investor Buy Lists for profits, I’m adding three fundamentally superior stocks in today’s Growth Investor Monthly Issue for February. Each stock is forecast to post strong results for its latest quarter, and analysts have revised their earnings estimates higher. Typically, positive analyst earnings revisions precede future earnings surprises, so I expect each to beat analysts’ estimates and rally on their strong results.

These stocks aren’t slated to report their latest results for another few weeks, so you still have time to jump in before they start firing on all cylinders once their earnings are out.

Become a member of Growth Investor today , and you’ll receive the names and ticker symbols of my newest recommendations, as well as my latest Top Stocks list as soon as the Monthly Issue is published. You’ll also have full access to all my past Monthly Issues, Weekly Updates, Special Market Podcasts – and much more!

Click here to become a member now.

(Already a Growth Investor subscriber? Go here to log in to the members-only website.) Sincerely, |

.png)

.png)

No comments:

Post a Comment