The Schrödinger’s Cat of Presidential Candidates | Editor’s Note: Hi, folks, it's Louis Navellier. Today, I have a special guest column from Charles Sizemore, Chief Investment Analyst at InvestorPlace's publishing partner, The Freeport Society. Charles published a brand-new special report – 5 Unapologetically Profitable Stocks for 2024 – where he shares five stocks that will help you survive and prosper through 2024 and beyond. Click here to get your FREE copy and to sign up for Charles' free e-letter, The Freeport Navigator .

The floor is yours, Charles... | | | Hello, Reader. An anonymous masked man is running for president of Ghana.

He hasn’t identified himself…

He hasn’t identified any of his policy proposals.

No one knows who he is or what he stands for.

He’s just “The Man in the Mask,” and his image covers billboards across the country. Here’s the official campaign ad on display.

I have no information on how this masked gentleman is polling in Ghana or what his odds of success are in next year’s election. It’s not the sort of thing that qualifies for space in The Wall Street Journal or The New York Times. I also can’t say if I’m pro-mask or anti-mask. It’s hard to form an opinion when I don’t know who he is or what he stands for.

Besides, nothing that happens in Ghana is likely to affect my life.

But if given the choice between an anonymous masked Ghanaian and any of the contenders in the 2024 U.S. presidential election, the former would get my vote.

However remote the possibility, he could be the next Reagan or Thatcher… or perhaps the reincarnation of George Washington himself! Call him the Schrödinger’s Cat of presidential candidates: an absolute unknown who could simultaneously be the best and worst candidate in history.

Unfortunately, our current crop of candidates are very well-known entities. We know good and well what we’re getting. And it’s not… well… good.

We’re getting continued deficit spending…

We’re getting more Federal Reserve intervention in the economy…

And we’re getting more special interest lobbying and grifting.

(My Freeport Society fellow and I also have a shocking election forecast that we’ll reveal today. If we’re right, all of those bad things will be infinitely worse. Watch your inbox tonight for that special presentation.)

We also know what we’re not getting.

We’re not getting reforms to make Social Security and Medicare viable over the long term.

We’re not getting thoughtful policy proposals.

And we’re not getting any potential fixes to the housing affordability crisis.

I don’t know that the mysterious masked Ghanaian would have anything better to offer. But I DO know that the cure to drug addiction isn’t more heroin… Yet that’s what our current crop of candidates is offering.

Speaking of…

Fed Promises, Old and New The Fed held its press conference on Wednesday. Jerome Powell is a man of his word. The central bank’s targeted interest rate range remains unchanged at 5.25% to 5.5%. That was widely expected.

But what few expected was Powell’s swing into decidedly dovish territory. For the first time, he said that the Fed’s targeted rate was “likely at or near its peak for this tightening cycle.”

In other words, no more rate hikes. He’s done.

But that’s not what jolted the market higher. The rocket fuel was this little tidbit from Powell’s prepared comments: FOMC participants wrote down their individual assessments of an appropriate path for the federal funds rate based on what each participant judges to be the most likely scenario going forward… If the economy evolves as projected, the median participant projects that the appropriate level of the federal funds rate will be 4.6 percent at the end of 2024, 3.6 percent at the end of 2025, and 2.9 percent at the end of 2026, still above the median longer-term rate. The Federal Reserve is expecting interest rates to be nearly a full percentage point lower by this time next year.

I’m not so sure about that. As I wrote on Thursday, the Fed’s job gets a lot harder from this point on. At this stage, labor-dependent services - rather than manufactured goods - are driving inflation. This makes rising prices a demographic problem, not a monetary one. Not even the omnipotent Fed Chair can snap his fingers and make new fully trained workers materialize out of the ether.

But, let’s say I’m being too pessimistic and, due to a productivity miracle, inflation in services falls enough to make the Fed’s rate cuts possible. (As Warren Buffett says, it’s generally a mistake to bet against America.)

Even then, Wall Street is still likely to be disappointed.

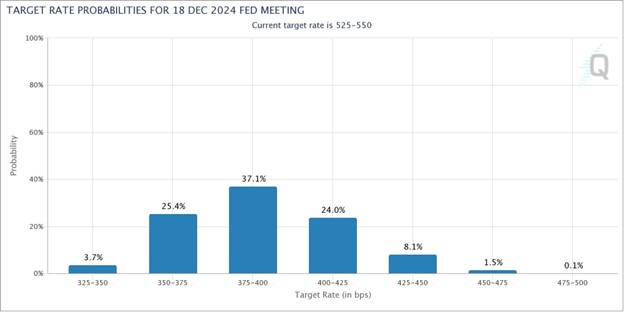

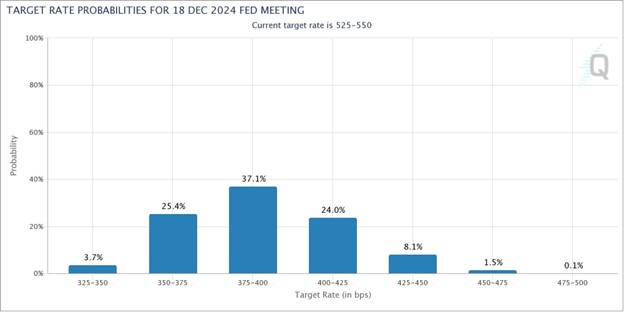

The futures market is pricing in only a 1.5% probability that rates will be anywhere near 4.6% by this time next year, as you can see in the chart below. In fact, it’s pricing in a 37% probability that the Fed cuts rates by 1.5% to 1.75% and a 30% probability they cut them significantly lower than that.  Let me be clear: Jerome Powell is not good at his job. We’re in this inflationary mess because he pumped an extra $5 trillion into the economy and believed that inflation was “transitory.”

But for all his faults, he’s transparent. Powell tells you exactly what he plans to do.

So, how exactly does this play out?

When the Fed doesn’t lower rates as much as the market is pricing in… what then? Do stock prices give back their Fed-inspired gains?

We’ll find out soon enough.

But if your returns depend on guessing the Fed’s next move correctly, you’re doing it wrong.

That’s not a game I want to play. I don’t want you playing it either.

I don’t want our returns to be at the whim of a fallible Fed Chair.

That’s why I focus on durable companies that have a way of making money no matter what direction the clown car in Washington happens to veer that day. Even if that clown car does end up including a masked presidential candidate.

Great American businesses, the Rich Man’s Currency, are one of the themes I cover in my special report - 5 Unapologetically Profitable Stocks for 2024 - which you can download for free right here.

To life, liberty, and the pursuit of wealth, |

.png)

.png)

No comments:

Post a Comment