How Intel Plans To Catch Up to NVIDIA in the AI Arms Race... Dear Reader, Artificial intelligence has taken the world by storm this year. In fact, according to IBM, 77% of companies are now using and/or exploring the use of AI for themselves.

AI was one of the fastest-growing industries of 2023… and it’s showing no signs of slowing down. AI’s market size is projected to grow 37% annually from 2023 to 2030 to reach $1.8 trillion. Not only that, but according to Forbes, AI is expected to contribute $15.7 trillion to the global economy by 2030.

Now, we’ve seen this year just how many companies are taking a gamble with AI.

For example, Amazon.com Inc. (AMZN) announced in September that it would invest up to $4 billion in Anthropic, an AI safety and research company founded in 2021 by former OpenAI employees.

Or consider Microsoft Corporation (MSFT). Back in October, the company debuted its own chip design for AI processing. The chip is designed for Microsoft’s data center servers that train and run large language models (LLMs).

Intel Corp. (INTC) is the most recent blue chip company to up the ante. Last Thursday in New York, Intel held its “AI Everywhere” event to unveil its latest AI portfolio additions.

This is a smart move by Intel because it has been falling behind in the chip wars for the past few years. And the company needs a big win to bring them back to the forefront and become a real competitor in the AI arms race.

So, in today’s Market 360, I want to cover the new products Intel revealed and the impact they could have on this storied blue chip stock. We’ll also take a look at one of Intel’s AI competitors, and then I’ll share which one is the better buy. Intel’s Growing AI Portfolio Intel’s new portfolio of AI products will enable customers to use AI solutions everywhere – through the data center, cloud, network, edge and PC.

The first product showcased was the Intel Core Ultra mobile processor family.

The company aims to launch what it calls the “AI PC generation” with the products, which offer everything from better computing power to battery life, including some “profound” new AI features.

According to Intel, when using a PC running on its Core Ultra, customers will find a larger and more extensive set of AI-enhanced applications will run much more smoothly. The company says this will amount to the largest transformation for the PC in 20 years… since Intel created laptops that can connect to Wi-Fi from anywhere.

PCs with these processors are available now on a limited basis, with a full rollout throughout 2024.

Next up was the 5th Gen Intel Xeon processor. Along with improved performance and efficiency, Intel claims this new processor also will lower the total cost of ownership by up to 77%.

Now, it is important to note that this generation of Xeon is the only mainstream data center processor with built-in AI acceleration, which helps artificial intelligence and machine learning applications.

While the official launch of the new generation of Xeon was last Thursday, consumers can expect them to officially roll out in the first half 2024.

To wrap up the event, Intel CEO Pat Gelsinger unveiled the company’s AI accelerator chip coming out next year: Intel Gaudi3. This chip is set to compete with rival chips from NVIDIA Corporation (NVDA) and Advanced Micro Devices, Inc. (AMD).

This is the first time Gelsinger has publicly shown the next-generation AI accelerator for deep learning and large-scale generative AI models.

The hope is that this accelerator will attract AI companies away from NVIDIA, whose H100 Tensor Core accelerator dominates the market. The Standout Leader in AI Now, whether these new products Intel unveiled will be a game changer is yet to be seen. Investors certainly seem to be excited – the stock climbed 1.4% in the wake of the AI Everywhere event and is up about 68% this year. In comparison, the tech-heavy NASDAQ is up about 42%.

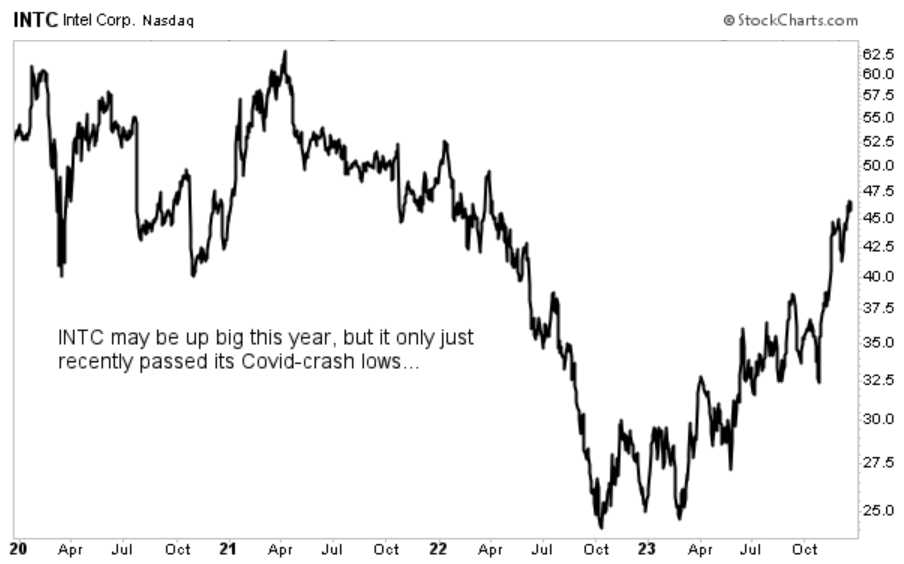

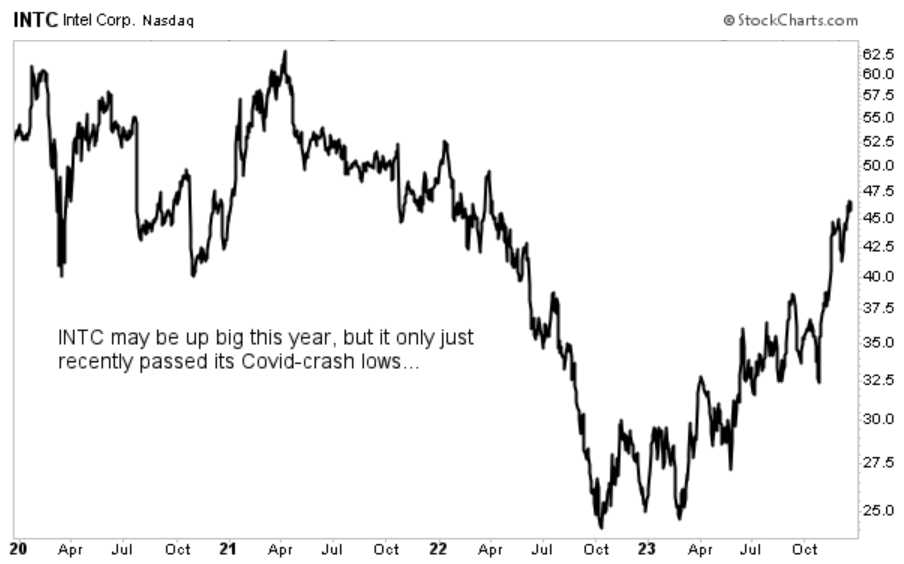

At first glance, this is a fantastic return. However, if you take a step back and look at the bigger picture… Intel’s performance is actually relatively weak. As you can see in the chart below, it only recently eclipsed the levels it was trading at during the Covid market meltdown – more than three years ago! The truth of the matter is the stock really only started to move when the AI interest earlier this year grew into a frenzy.  Meanwhile, if you follow my Growth Investor service, you probably know that NVDA is up even more – to the tune of 237% this year. The truth of the matter is that NVIDIA already has a dominant grip on the market. NVIDIA is at the forefront of the AI movement. Its chips are used in everything from data centers to autonomous vehicles.

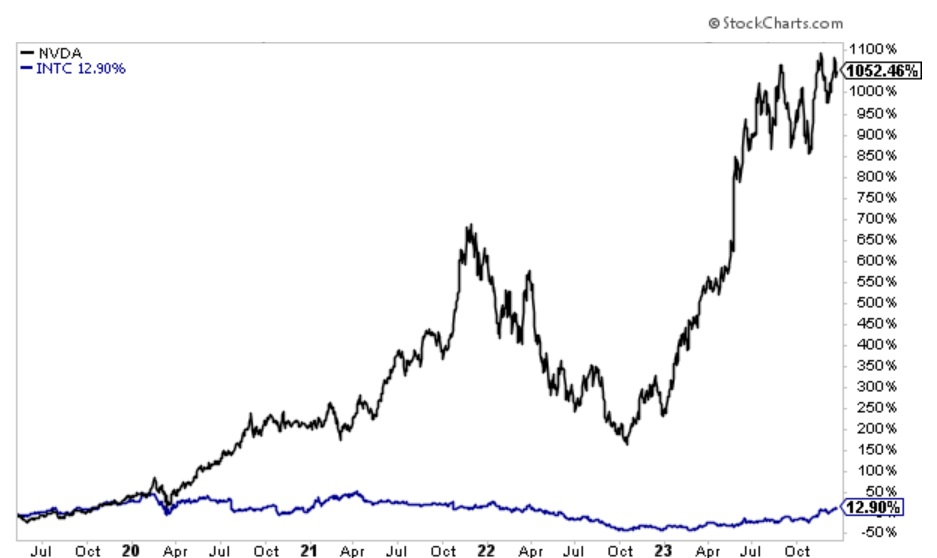

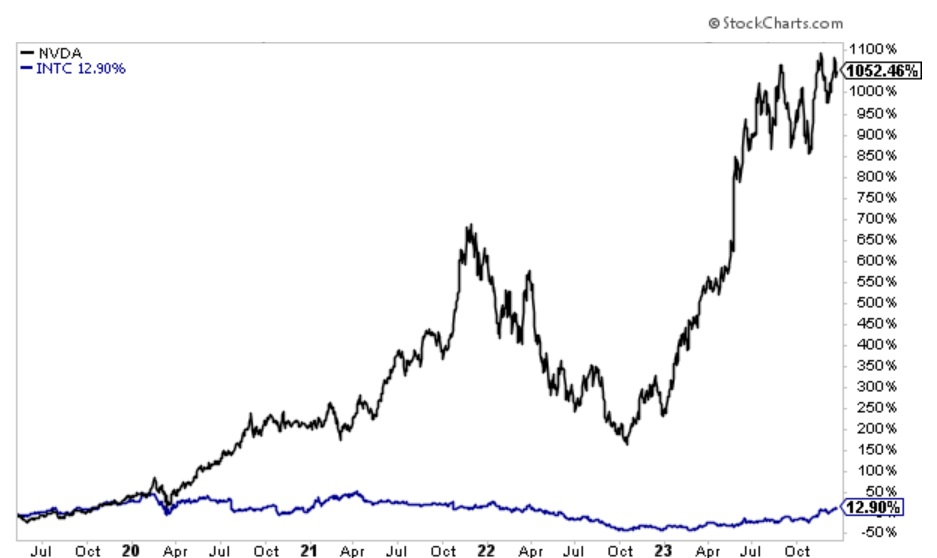

And since I recommended NVIDIA back in May 2019, my Growth Investor subscribers have seen an over 1,000% return so far! (INTC is only up a measly 13% during that time.)  NVIDIA also boasts impressive fundamentals. Case in point: The company’s third-quarter sales surged 205.6% to $18.12 billion, compared to $5.93 billion in the same quarter a year ago. Data center revenue accounted for a record $14.51 billion, or a 279% year-over-year increase. The consensus estimate called for total revenue of $14.84 billion.

During the same period, earnings soared a stunning 1,274.1% to $9.24 billion, or $3.71 per share. This compares to earnings of $680 million, or $0.27 per share, a year ago. Excluding extraordinary items, Nvidia’s operating earnings were $4.08 per share.

INTC, meanwhile, released third-quarter earnings per share of $0.41. Third-quarter revenue came in at $14.2 billion, down 7.2% from revenue of $15.3 billion during the third quarter in 2022.

Consensus estimates for the third quarter called for earnings per share of $0.22 and revenue of $13.60 billion. So, INTC did beat expectations by 86% for earnings and 4% for revenue.

The bottom line: NVDA is firing on all cylinders and INTC isn’t.

And what’s more, the stock is only trading for about 24 times next year’s projected earnings. That’s a very reasonable valuation for one of the best growth stories on the market.

So, even with Intel’s new products and stronger performance this year, NVDA remains the better AI buy.

While I am very bullish on NVDA – and the AI industry, for that matter – that doesn’t mean you should put all your money into NVDA. You need to invest across a range of industries to have a fully diversified portfolio to protect your hard-earned money during the market’s ups and downs.

It’s why just yesterday, to help best position my Growth Investor Buy Lists for next year, I added two fundamentally superior stocks in the Growth Investor Monthly Issue for January. I also shared my latest Top Stocks for both the High Growth Investments and Elite Dividend Payers Buy Lists.

So, to access these new buys,join me at Growth Investor today and read the issue now. Once you become a Growth Investor member, you also have full access to my latest Top Stocks, both Buy Lists, past Monthly Issues, Weekly Updates, Special Market Podcasts, and much more.

Click here for more details.

(Already a Growth Investor subscriber? Click here to sign in now.) |

.png)

.png)

No comments:

Post a Comment