Two EV Players Announced Earnings This Week… Which Came Out on Top? Dear Reader, Battery suppliers and automakers alike are falling victim to slowing electric vehicle (EV) sales as of late.

One casualty of falling EV sales is Tesla Inc.’s (TSLA) primary battery supplier, Panasonic Holdings Corp. (PCRFY) lowered its 2023 battery profit forecast 15%. Although Panasonic has geared up to build Tesla’s new 4680 battery cells, the Tesla EVs above $80,000 are not selling well. If Panasonic is struggling to make money building EV batteries, all the other new battery plants in the U.S. are also expected to struggle.

There is also a potential problem brewing with General Motors Company (GM) and its battery supplier, LG Energy Solution. Currently, the cost of running a battery plant in the U.S. is double the costs of other regions, so LG Energy Solution, SK On and Samsung SDI are increasingly cautious about their plans to spend $28 billion on new U.S. battery plants in joint ventures with automakers.

GM also announced that it is abandoning a self-imposed target for the number of EVs it aims to produce through the middle of next year because of this softening consumer demand. Recently, GM delayed its Orion EV truck factory after a burst of consumer EV demand faded.

And as if GM did not have enough problems, the California Department of Motor Vehicles (DMV) suspected the company’s Cruise autonomous vehicle driving permit. Cruise is majority controlled by GM, which paid $1 billion for its controlling stake in early 2016.

In fact, the National Highway Traffic Safety Administration (NHTSA) recently said it opened a safety-defect probe into nearly 600 driverless cars operated by Cruise, which likely influenced the California DMV. Cruise has been expanding nationwide over the past few months, introducing cars in Miami, Nashville and other cities. However, the NHTSA investigation will likely be a hurdle for both GM and Cruise.

Lack of demand for EVs is also weighing on Ford Motor Company (F) and Stellantis (STLA).

In fact, Ford is now losing $36,000 on every EV it sells, so it lost $1.3 billion on the 20,962 EVs it sold in the third quarter. Ford also recently announced that it is postponing $12 billion in planned spending on EVs. Essentially, the high prices are one of the big reasons consumers are avoiding EVs. Here’s what Executive Chair Bill Ford stated in a The New York Times interview: Electric vehicles are expensive. We know prices will come down, and as that happens, we will have a bigger ramp-up of E.V.s. Keep in mind: The most valuable company that our industry has ever seen is Tesla, and it’s growing. That’s a very instructive point when people say E.V.s are not desired. Likewise, Stellantis is pushing back on EVs and even Tesla is now forecasting that it will be losing money on its Cybertruck, which will begin shipping in late November. As I said when I reviewed Tesla’s quarterly earnings report last month, CEO Elon Musk also signaled that the Cybertruck would not be profitable for at least 18 months. He cautioned that “it is going to require immense work to reach volume production and be cashflow positive at a price that people can afford.”

With Rivian Automotive Inc. (RIVN) and Lucid Group Inc. (LCID) up to bat with their earnings reports this week, investors were curious to see if they were facing the same headwinds. So, in today’s Market 360, let’s take a look at their earnings reports. And then I’ll share which of these, if either, is a good buy after earnings, as well as the automaker I think is the best buy in the EV space. A Look Under the Earnings Hood Rivian Automotive Inc.

The company announced its fourth-quarter results after the market close on Tuesday, November 7.

For the third quarter in 2023, Rivian reported revenue of $1.34 billion, which bested analysts’ estimates for revenue of $1.31 billion. The company also revealed an earnings loss of $1.19 per share, which topped analysts’ expectations for an earnings loss of $1.32 per share.

The company noted it produced 16,304 vehicles in the third quarter, which represents the strongest quarterly production to date. It also delivered 15,564 vehicles in the third quarter. With this, Rivian bumped its forecasted vehicle production from 50,000 vehicles to 54,000 vehicles for 2023, which would about double last year’s production. However, the number was below expectations for 60,000 vehicles.

In a letter to shareholders, company management also reiterated its commitment with Amazon.com, Inc. (AMZN) to bring more Rivian electric delivery vehicles (EVD) to market: Amazon and Rivian remain focused on bringing 100,000 Rivian electric delivery vehicles (“EDV”) to the road, which will help save Amazon millions of metric tons of carbon per year. Amazon now has over 10,000 EDVs in its fleet that have delivered over 260 million packages to customers in more than 1,800 cities and regions across the U.S.. Earlier this year, Amazon also rolled out its first EDVs in Germany. Following the earnings report, Rivian shares opened 6.7% higher on Wednesday, though they gave up the early gains, ultimately ending the day down 2.4%.

Lucid Group Inc.

Lucid also reported its third-quarter earnings Tuesday afternoon.

For the third quarter, Lucid reported revenue of $137.81 million, compared to revenue of $195.5 million in the third quarter of 2022. This missed analysts’ expectations for revenue of $193.68 million. The company also revealed an earnings loss of $0.25 per share, which bested analysts’ expectations for an earnings loss of $0.40 per share.

For the quarter ending September 30, 2023, Lucid produced 1,550 vehicles at its Arizona facility and delivered 1,457 vehicles during the same period. Looking ahead, Lucid’s forecasted production volume is 8,000 vehicles to 8,500 vehicles in 2023, down from previous guidance for more than 10,000 vehicles.

In the company’s earnings press release, Lucid CFO Sherry House noted: We are seeing results from our targeted marketing approach, as the majority of new demand came from customers who had their first contact with Lucid in the quarter. We've also made progress with the cost control program we implemented in the first half of the year and have identified further opportunities for 2024. We ended the third quarter with approximately $5.45 billion in liquidity, which we expect to lead us to our next major milestone, Gravity production, and beyond, into 2025. Following the earnings report, Lucid shares opened 5.6% lower on Wednesday and continued to build on those losses throughout the day, ending Wednesday down 8.1%.

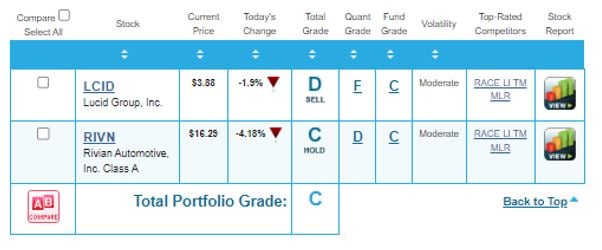

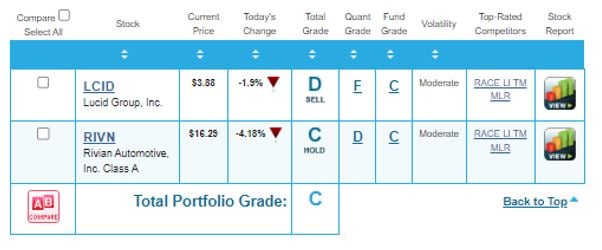

So, now the question is if either is a good buy after earnings? According to my Portfolio Grader, that’s a “no.”

As you can see below, Lucid holds a D-rating, making it a sell. Rivian’s C-rating is a little bit better, but it means that it’s a “Hold.” So, if you do not currently own shares of Rivian, my Portfolio Grader recommends not buying it.

I want to also note that both companies earn low ratings for their Quantitative Grade, which tells me that institutional buying pressure is drying up. The more money that floods out of a stock, the more momentum a stock has to fall. So, poor Quantitative ratings are always a bad sign.

The bottom line: Neither Lucid nor Rivian are good buys right now. The Best EV Buy Right Now Personally, I think the best EV buy is Volkswagen AG (VWAGY).

Volkswagen has recently passed Tesla to be the EV leader this year in Europe. This is thanks to its Audi, Bently, Porsche, Seat, Skoda and VW brands that are selling EVs as well as plug-in hybrids. Now that Volkswagen has nearly 25 EV models, it is winning the EV war for market share thanks to its great designs and many different models. The ID.buzz is expected to be VW’s biggest EV hit and a larger, long-range version of ID.buzz is heading to North America.

So, while there remains a glut of EVs for sale, VW has the financial strength to offer lower interest rates to stimulate sales as well as offer special leases that consumers demand.

And speaking of financial strength, Volkswagen released its most recent earnings on Thursday, October 26. For the first nine months of 2023, VW delivered 6.7 million vehicles, or an 11% year-over-year increase. The company noted that 2.3 million of these vehicles were delivered in the third quarter, which represents a 7% year-over-year increase.

Looking forward, Volkswagen still expects to deliver between 9.0 million and 9.5 million vehicles in fiscal year 2023. Sales are anticipated to grow between 10% and 15%.

The reality is, unlike the other big EV players, Volkswagen has the fundamentals to back it up.

But in an environment where EV companies are struggling, you don’t want to put all your eggs in Volkswagen’s basket. It’s important to diversify to balance out your portfolio, especially in the current market environment. So, make sure to load up on fundamentally superior companies across a variety of sectors to ensure that you’re investing in stocks that will “zig” when others “zag.”

If you’re not sure where to look, then consider my Growth Investor service. Here, I recommend more than 50 stocks across a range of industries. They also boast superior fundamentals and have posted strong earnings results this earnings season.

As of last Friday, I’ve had 52 companies release results from their latest quarter. Of these companies, 43 topped analysts’ estimates. My average earnings surprise is an impressive 10%.

Plus, my Growth Investor stocks remain characterized by 160.8% annual earnings growth and have benefitted from a 7% increase in analysts’ estimates over the past three months.

To learn more about Growth Investor and how to access all my Buy List stocks, click here.

(Already a Growth Investor subscriber? Click here to log in to the members-only website.)

Sincerely, |

.png)

.png)

No comments:

Post a Comment