Inside Biden’s “Most Significant Action” on AI Regulations Dear Reader, Imagine floating in the ocean.

The sun above you, the shore close by – but a depth down below. And the further out you go, the more you become aware of that depth, not knowing what life, or dangers, exist below the surface.

Now, think of artificial intelligence like the ocean.

It’s expansive, undeniably so, and still largely undiscovered.

As the full impact, and consequences, of AI are still unknown, each new wave of advancement brings potential risks and danger. So, just like at the beach, a “lifeguard” may be needed.

On Monday, whether or not AI developers in Silicon Valley and around the nation like it or not, the White House took on the role.

So, in today’s Market 360 , let’s take a look inside what President Biden called the “most significant action any government anywhere in the world has ever taken on AI safety, security and trust.” Even with new AI regulations in place, there are still plenty of profits to be made in AI stocks. So, I’ll also share what to look for when investing in an AI stock… and the AI stock I like the most. Safeguarding AI’s Uncharted Waters Using the “force of law,” President Joe Biden signed an executive order that sets out some rules and regulations for generative AI. It is the first executive order on the matter – and the U.S. government’s most ambitious attempt at addressing concerns about AI.

Previous AI guardrails in the U.S. consisted of voluntary safety pledges from many of the big tech companies.

Ever since the first appearance of ChatGPT in November 2022, users have uncovered misinformation and bias in it and other AI tools.

Biden’s order attempts to address these concerns.

Sweeping in scope, the order is broken down into eight parts: - Creating new safety and security standards for AI.

- Protecting privacy.

- Advancing equity and civil rights.

- Protecting consumers, patients, and students.

- Supporting workers.

- Promoting innovation and competition.

- Working with international partners.

- Ensuring responsible government use of the technology.

Moreover, the order tasks several government agencies to create standards to hit these objectives.

The National Institute of Standards and Technology (NIST) is responsible for creating safety tests for companies building advanced AI. Using the Defense Production Act of 1950, the NIST will “red team” AI models before their public release, notifying the government about the results. However, the White House is not going to recall any AI models that are already public.

The Department of Energy is charged with ensuring that AI systems don’t pose chemical, biological, radiological, nuclear and/or cybersecurity risks, while the Department of Defense and Homeland Security will address the potential threat of AI to computers and infrastructure.

The Commerce Department is directed to watermark AI-generated content, like audio or images, in an effort to identify “deepfakes.” A deepfake is the use of AI technology to visually alter an individual’s appearance so that they appear as someone else – usually a well-known figure like a celebrity or politician. The deepfake allows its creator to make their target say or do something they did not actually do.

So far, most of the big AI players are not pushing back. In a statement, Microsoft Corporation (MSFT) Vice Chairman and President Brad Smith said he views the order as “another critical step forward in the governance of AI technology.” Staying in Steady Waters As AI companies will have to work with Biden’s new regulations, there is no telling how they will be affected – for better, or worse. So, if you’re looking to invest in an AI company, you’ll want to make sure that it has superior fundamentals. That is, stocks with strong earnings momentum and sales growth, as well as positive analyst revisions.

For me, that’s NVIDIA Corporation (NVDA).

The company has impressive forecasted earnings growth, thanks primarily to the strong demand for its AI chips. Now, we’ll find out just how strong its fundamentals are on November 21, when NVIDIA will report results for its third quarter in fiscal year 2024.

Third-quarter earnings are expected to soar 444.8% year-over-year to $3.16 per share, compared to $0.58 per share in the same quarter a year ago. Analysts have also increased earnings estimates by 53.3% over the past three months. So, a fourth-straight quarterly earnings surprise is likely.

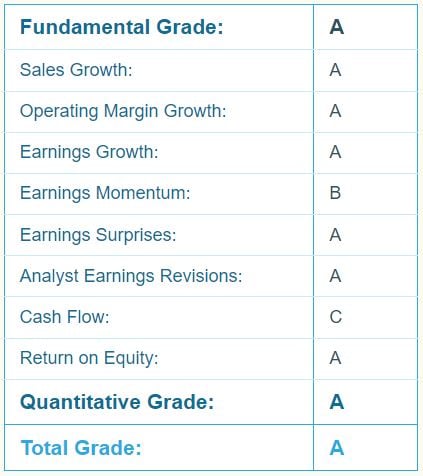

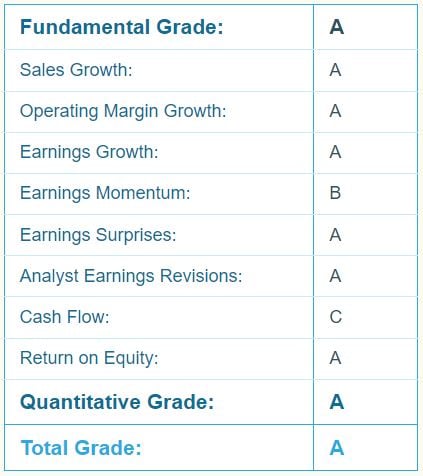

It is also highly rated in Portfolio Grader…

As you can see in the report card above, it holds an A-rating for both its Fundamental and Quantitative Grades, making it an AA-rated stock – and “Strong Buy” – right now.

Of course, you don’t want to invest in only AI stocks (or one stock); you need to invest across a range of industries to have a fully diversified portfolio to protect your hard-earned money during the market’s ups and downs.

In Growth Investor, I am focused on the five best corners of the market, which allows my subscribers to profit even when the market turns.

To gain access to my Buy Lists now, join me today at Growth Investor. You’ll also get immediate access to all my Monthly Issues, Weekly Updates, Special Market Podcasts and Special Reports.

Click here to become a member of Growth Investor today.

(Already a Growth Investor subscriber? Click here to log in to the members-only website.)

Sincerely,

|

| Louis Navellier

Editor, Market 360 P.S. The big tech companies recognize the impact that AI is having, with each focusing on and infusing it into their companies as they look ahead to the next quarter and even next year. And just as they see the opportunity on the horizon, I firmly believe that the AI boom we’re witnessing will be the biggest opportunity of the next decade.

To take advantage, all you have to do is apply my “Billion Dollar Tech Blueprint” to the AI market and you could turbocharge your investment portfolio in a major way.

And it will work best if you act now while the majority of AI-related stocks are still small and relatively unknown. The AI boom is just getting started and you don’t want to miss out.

That’s why I created this urgent message to share with you how my time-tested “Billion Dollar Tech Blueprint” can properly position your portfolio for the chance to make the most money possible from the AI Revolution.

Click here to watch it now. The Editor hereby discloses that as of the date of this email, the Editor, directly or indirectly, owns the following securities that are the subject of the commentary, analysis, opinions, advice, or recommendations in, or which are otherwise mentioned in, the essay set forth below:

NVIDIA Corporation (NVDA) |

.png)

.png)

No comments:

Post a Comment