Is NVIDIA a Good Buy After the White House AI Chip Sale Ban? Dear Reader, Jensen Huang, CEO of NVIDIA Corporation (NVDA), faced a huge problem last September.

The U.S. government placed restrictions on the export of high-end semiconductor chips to China and Russia – of which NVIDIA is a market leader. This, of course, posed a large financial threat to the company.

But Huang’s a smart, resourceful guy… and he found a solution.

The export restrictions banned the NVIDIA H100, which is the company’s flagship semiconductor chip. So, by November, the chip leader had created slowed-down versions of the chip, called the H800 and A800. This allowed China to continue to buy NVIDIA’s chips.

Plot twist: Last week, the Biden administration officially closed this loophole, hindering China’s ability to purchase any advanced semiconductors from the United States – including those from NVIDIA.

The stock slipped 5% in response.

In today’s Market 360, we’ll take a closer look at the new AI chip regulations and how they’ll impact NVIDIA. And then, I’ll share if NVIDIA is a buy following its recent weakness or a stock to avoid.

Here’s what you need to know… The White House Hits NVIDIA With Big Regulations The Commerce Department plans to significantly limit U.S. exports of AI and other high-end chips to China – and it all boils down to national security.

Commerce Secretary Gina Raimondo says the new regulations are aimed at regulating “access to advanced semiconductors that could fuel breakthroughs in artificial intelligence and sophisticated computers.”

In other words, the White House is concerned that China will use such chips in critical military applications, potentially putting it one step ahead of the U.S. in defense technologies. Through the supercomputing fueled by advanced semiconductor chips, AI could improve both the speed and accuracy of military planning, logistics, and, ultimately, decision making.

Although the new export rules were supposed to go into effect in 30 days from October 17, NVIDIA revealed in an 8k filing on Monday that the Biden administration had told the company that it was to stop selling its A100, A800, H100, H800, and L40S chips to China “effective immediately.”

However, NVIDIA management says it doesn’t anticipate any “near-term meaningful impact” on its business, and that it will continue to comply with all applicable regulations.

Now, China is not the only country affected by these measures. Iran and Russia also face restrictions in accessing advanced U.S. semiconductors and chip-making tools.

Raimondo says China will still be able to import hundreds of billions of dollars’ worth of less-advanced U.S. semiconductors. However, limiting the export of advanced chips hinders NVIDIA’s ability – as well as that of other big chip manufacturers like Intel Corp. (INTC) and Advanced Micro Devices Inc. (AMD) – to sell their AI-focused products to China.

Regardless, Wall Street reacted harshly to the new restrictions, and NVIDIA shares headed lower last week, and again this week.

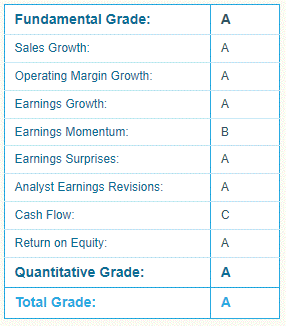

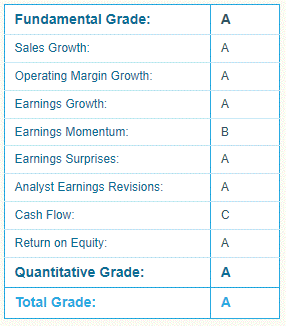

So, should you buy NVDA’s dip? Portfolio Grader Says… According to my Portfolio Grader, that answer is “yes.” NVIDIA is still a “Strong Buy,” as evidenced by its current A-rating.

As you can see in the report card above, NVIDIA also earns an A-rating for its Fundamental and Quantitative Grades. So, not only does NVIDIA boast superior fundamentals, but its A-rating for its Quantitative Grade indicates that the stock continues to experience persistent institutional buying pressure. In other words, money is still flowing into the stock.

It’s also worth noting that the analyst community remains bullish on NVIDIA.

NVIDIA is scheduled to release its third-quarter earnings on November 21. Analysts expect earnings to surge 444.8% year-over-year to $3.16 per share, and they anticipate revenue coming in at $15.19 billion. Earnings estimates have been revised higher in the past three months, so a fourth-straight earnings surprise is likely.

I should also add that we’re still in the very early innings of the AI Revolution. And within the next few months, I firmly believe that AI will transform every aspect of our lives.

And given that NVIDIA remains the dominant player in the AI space, it stands to make huge profits as the AI Revolution rolls on.

The bottom line : NVIDIA is a good buy right now. And given that the company continues to boast fantastic fundamentals, it’s likely gearing up for a big earnings surprise on November 21, which could dropkick and propel shares significantly higher.

(Already a Growth Investor member? Click here to log in to the members-only website now.) Sincerely, |

| Louis Navellier

Editor, Market 360

P.S. The big tech companies recognize the impact that AI is having, with each focusing on and infusing it into their companies as they look ahead to the next quarter and even next year. And just as they see the opportunity on the horizon, I firmly believe that the AI boom we’re witnessing will be the biggest opportunity of the next decade.

To take advantage, all you have to do is apply my “Billion Dollar Tech Blueprint” to the AI market and you could turbocharge your investment portfolio in a major way.

And it will work best if you act now while the majority of AI-related stocks are still small and relatively unknown. The AI boom is just getting started and you don’t want to miss out.

That’s why I created this urgent message to share with you how my time-tested “Billion Dollar Tech Blueprint” can properly position your portfolio for the chance to make the most money possible from the AI Revolution.

Click here to watch it now.

The Editor hereby discloses that as of the date of this email, the Editor, directly or indirectly, owns the following securities that are the subject of the commentary, analysis, opinions, advice, or recommendations in, or which are otherwise mentioned in, the essay set forth below:

NVIDIA Corporation (NVDA) |

.png)

.png)

No comments:

Post a Comment