Size Matters When Buying Stocks | A Note From Louis: On Wednesday, Sep. 27 at 8:00 p.m. ET, Eric Fry is joining TradeSmith CEO Keith Kaplan for a special event centered around the one topic no one can stop talking about: artificial intelligence (AI).

And I know it may sound shocking considering its atmospheric climb this year, but NVIDIA is NOT the biggest AI story out there…

And neither is Amazon, Apple, Microsoft, or Google. When it comes to AI, most investors are missing a much bigger opportunity… A tiny startup has created a massive gamechanger in the markets – with innovations that are giving a small number of ordinary Americans the chance to make up to 11X MORE on every stock, ETF, or fund they own.

Keith and Eric will explain it all on Wednesday, so make sure you’re there. Click here to save your spot.

In the meantime, I wanted to pass along a special guest column from Keith where he shares all about this amazing new development… | | | Dear Reader, Keith Kaplan here, CEO of TradeSmith.

Perfect position sizing will make all the difference in the world.

I’ll tell you exactly how NOT to buy a stock … just like younger me!

Look, this happened to me a lot: I’d read a great story and get excited. And then I’d make an emotional, in-the-moment decision to buy every single time. Then I’d get cold feet minutes, hours, or days later, and I’d sell. But on the flip side of coin, when I bought a stock that was rising slowly, I’d get impatient and sell early.

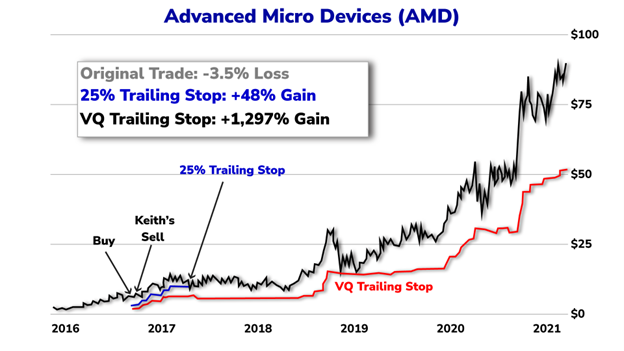

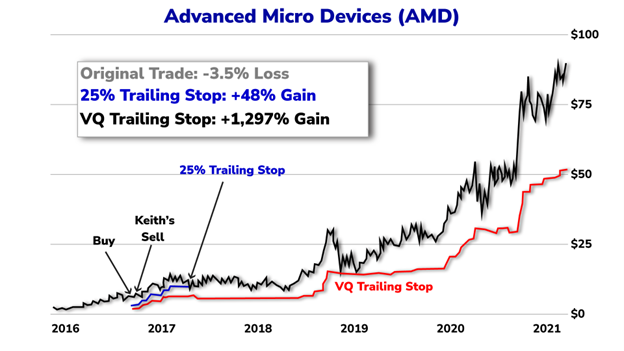

It happened with Advanced Micro Devices Inc. (AMD) and many other times. I read a story that made it clear to me that AMD was about to soar to new heights. That meant I had to buy AMD right then and there. At that time, AMD was trading under $10 a share. As I’m writing this, AMD is up more than 1,200% in the five years that have passed.

So, I was right in buying. But I did it all wrong. And that caused me to sell pretty quickly, losing 3.5% instead of gaining a whopping 1,200%.

Sheesh.

The rollercoaster of the market, or the individual stock, used to throw me for a loop every single time. So, what does that tell you about younger me? I was impulsive and expected 100% gains in no time. BUT I had no tolerance for risk. I wanted the reward, not the risk of owning a stock.

And that’s really because I didn’t understand how to buy a stock. I didn’t understand how to blend it into a robust portfolio primed for gains and minimal losses. I was putting way too much money into risky stocks and not enough into low-risk stocks.

We’re talking about “position size” here – the number of shares of a stock you buy, establishing a “position” in that stock.

We want to establish a portfolio of stocks (or other instruments) that gains over time and minimizes losses.

Now, trailing stops are important to minimizing risks and maximizing gains. They give you a logical plan for when to sell a stock and when to ride a stock for major upside.

But here’s the thing – the real geniuses use risk parity.

Ray Dalio, a billionaire hedge fund manager, uses risk parity at his quant-based hedge fund, Bridgewater Associates. This guy is a genius and inspired me many years ago with his “All-Weather Portfolio,” designed to weather storms by minimizing losses and maximizing gains. Of course, he’s crushed the market with his returns, and most importantly, he’s done so in a lower-risk manner.

Risk parity is the concept of investing based on allocation of risk using volatility instead of other commonly used metrics (such as market cap). You essentially wind up buying the same stocks, but you put LESS money into higher volatility (riskier) stocks and MORE money into lower volatility (less risky) stocks. And you sleep much better at night because you did so!

Your goal is to have your portfolio as a whole rise over time with the least amount of fluctuation to get you there. Risk parity is the answer.

In our system, we offer something called a Position Size Calculator. It has three different scenarios for how to buy a stock. - You could say, “I want to risk $1,000; how much of this stock should I buy?”

- Or let’s say you have a $100,000 portfolio. You could say, “I’d like to risk 2% of my portfolio; how much should I buy?”

- And finally, you could say, “I want to buy this stock with equal risk to the stocks in my portfolio; how much should I buy?”

This tool is VERY user friendly, and it’s set to walk you through the perfect position sizing for your portfolio in less than a minute. So, let’s say I want to buy Tesla Inc. (TSLA) using the examples above. We classify TSLA as a highly volatile stock. In fact, in our system, we label it with our proprietary measurement of volatility, called the Volatility Quotient (VQ), at around 50%. That’s a really risky stock.

And I recommend buying it if you love it because you want risky/volatile stocks to help your portfolio move higher, but you just don’t want to buy too much of those types of stocks.

So, in our scenarios above, here’s how much TSLA you’d buy…

- Willing to risk $1,000 … buy about $2,000 worth of TSLA.

- You have a $100,000 portfolio that you’re willing to risk 2% – buy about $4,000 worth of TSLA.

- You have an existing portfolio in which you want equal risk among your positions – this will depend on your portfolio, but in my portfolio, it says to buy 12 shares in this scenario.

The goal here is to buy the right amount of a stock to minimize your risk while maximizing your gains.

Your position size matters a LOT. Don’t get it wrong. Don’t buy too much of a risky stock and not enough of a low-risk stock. You must find (and keep!) the right blend to maximize your potential gains while lowering your risk.

I never realized until I had these tools that I had it all wrong. I was buying just a little bit of the low-risk stocks and a lot of the high-risk stocks and then overtrading because I couldn’t sleep at night!

It’s time to get better sleep, so discover how you can lower your risk on the same stocks you own today and maximize your reward …

We’ll talk about this and more on Wednesday, Sep. 27, when Eric Fry and I take the stage to show you the next big step in making artificial intelligence work for you…

For now, save your spot for this event by clicking here.

All the best, |

.png)

.png)

No comments:

Post a Comment