Retail Sales and Retailer Earnings Results Are Out – Here’s What You Need to Know Dear Reader, This week was a very big one for retail… ranging from the July retail sales report to three big retailers’ quarterly earnings reports.

The reality is these announcements would provide clues on the health of the consumer and the impact of inflationary pressures, so Wall Street analyzed each report closely.

In today’s Market 360, we’re going to do the same. We’ll dive into the details of the July retail sales report and discuss what this tells us about the U.S. economy. We’ll also review the quarterly earnings of the big-box retailers – The Home Depot, Inc. (HD), Target Corporation (TGT) and Walmart Inc. (WMT).

And then, I’ll share if the retailers are good buys after earnings.

Let’s dig in… The July Retail Sales Report The July retail sales report was released on Tuesday – and it was great!

The Commerce Department announced that retail sales rose 0.7% in July, which was substantially higher than economists’ consensus expectation for a 0.4% increase. This was the fourth-straight month that retail sales have risen and the pace of consumer spending continues to accelerate.

Online sales surged 1.86% in July and was led by Amazon’s Prime Day. Spending at bars and restaurants rose 1.41%, which is a clear sign that consumers are out and about.

However, consumers were not spending on big-ticket items, since auto sales declined 0.29% in July, furniture sales dropped 1.77% and electronics and appliance sales declined 1.26%.

Excluding auto sales, retail sales rose an impressive 1% in July, which also topped expectations for a 0.4% rise. So, the U.S. economy remains consumer-driven, and the latest retail sales report ignited big revisions to forecasted GDP growth. The Atlanta Fed now expects the U.S. economy to grow at a 5.8% annual pace in the third quarter, which is up from previous estimates for a 4.1% annual pace last week. The Home Depot, Inc.

Home Depot announced its second-quarter earnings before the opening bell on Tuesday, August 15. The company reported earnings of $4.65 per share on revenue of $42.92 billion, down from earnings of $5.05 per share and revenue of $43.79 billion in the same quarter of last year. Analysts were calling for earnings of $4.45 per share and revenue of $42.23 billion. So, Home Depot topped earnings expectations by 4.5% and missed revenue estimates by nearly 2%.

While Home Depot beat earnings expectations, the demand for do-it-yourself (DIY) projects – that became highly popular during COVID – has moderated.

“We were pleased with our performance in the second quarter,” said Ted Decker, chair, president and CEO. “While there was strength in categories associated with smaller projects, we did see continued pressure in certain big-ticket, discretionary categories.

Decker also said in the company’s earnings release that the home improvement retailer will be responding to “evolving customer dynamics” going forward.

During the earnings call, Decker also shared his thoughts on recession fears and the consumer. He stated: "As we all know, the economy continues to grow with a number – another great GDP print for the second quarter. And fears of a recession or at least a severe recession have largely subsided, and the consumer is generally healthy."

And regarding inflation, Decker believes that “the cycle of inflation is essentially behind us.”

For the third quarter, Home Depot expects earnings of $3.79 and revenue of $37.85. The company also maintained fiscal year 2023 guidance. Compared to a year ago, sales and comparable sales are expected to slip between 2% and 5%, while adjusted earnings per share are anticipated to fall between 7% and 13%.

Shares of HD rose nearly 1% on Tuesday following the earnings beat and bullish comments. Target Corporation Target released second-quarter earnings early Wednesday, August 16 – and the results were mixed. The company reported earnings of $1.80 per share, up a whopping 362% year-over-year from earnings of $0.39 per share, and higher than the $1.39 per share expected. Target reported revenue of $24.77 billion, compared to the $25.16 billion expected – and fell 5% year-over-year.

The reality is Target has faced difficulties for a while now.

In the second quarter of 2022, the company struggled with a surplus of unwanted merchandise. In the earlier days of the pandemic, sales for home decor, loungewear, increased as people led their lives from home. As there was increasingly less desire for these items, the company offloaded the inventory that had built up. However, inventory fell 17% compared with the year-ago period.

This quarter, shoppers kept their wallets tight due to the potential threat of inflation. Target’s comparable store sales dropped 4.3%. The company’s digital comparable sales dropped 10.5%.

In the company’s earnings release, CEO Brian Cornell said: Our second quarter financial results clearly demonstrate the agility of our team and the resilience of our business model, as we saw better-than-expected profitability in the face of softer-than-expected sales. With the benefit of a much-leaner inventory position than a year ago, the team was able to quickly respond to rapidly-changing topline trends throughout the second quarter, while continuing to focus on the guest experience. So, the company remains optimistic. Cornell also said that "as we move into the Fall, the team is gearing up for the biggest seasons of the year.”

However, company management still lowered their projections for the full year. They now anticipate full-year 2023 adjusted earnings between $7.00 and $8.00 per share, down from previous estimates for earnings between $7.75 and $8.75 per share.

Despite the mixed results, shares of TGT ended Wednesday 3% higher. Walmart Inc. Walmart reported its second-quarter earnings on Thursday, August 17, before the market opened.

In short, the company reported a blowout quarter.

Earnings came in at $1.84 per share, compared to expectations for earnings of $1.71 per share. Revenue rose 5.7% year-over-year to $161.63 billion, versus the $160.27 billion expected.

The company’s e-commerce sales jumped 24% year-over-year, as customers placed more orders for store pickup and delivery. Chief Financial Officer John David Rainey said, “It really shows that the value proposition for Walmart is much, more than just low prices or value. It’s convenience today.”

Rainey also said that there was “modest improvement” in sales of big-ticket items, like electronics, but the quarter’s seasonal moments, like the Fourth of July and back-to-school, really helped drive sales.

Looking forward to the upcoming holiday season, though, the company remains cautious about the amount of merchandise it will be ordering. Rainey said that higher energy prices and the “resumption of student loan payments in October” could put pressure on consumers. For the third quarter, Walmart expects adjusted earnings between $1.45 and $1.50 per share and for revenue to rise about 3%. The company also revised its guidance for fiscal year 2024. Revenue is anticipated to increase 4% to 4.45% and adjusted earnings are forecast to come in between $6.36 and $6.46 per share. This compares to previous estimates for a 3.5% increase in revenue and adjusted earnings between $6.10 and $6.20 per share.

Despite its earnings beat and positive guidance, WMT shares ended Thursday 2% lower. However, the pullback was likely due to profit-taking as shares had reached a new 52-week high of $162.78 ahead of the report. Are the Retailers Good Buys? Retail certainly had a strong week, with a positive July retail sales report and three big retailers announcing earnings beats. So, let’s now see how Home Depot, Target and Walmart stack up in my AI Mastermind system…

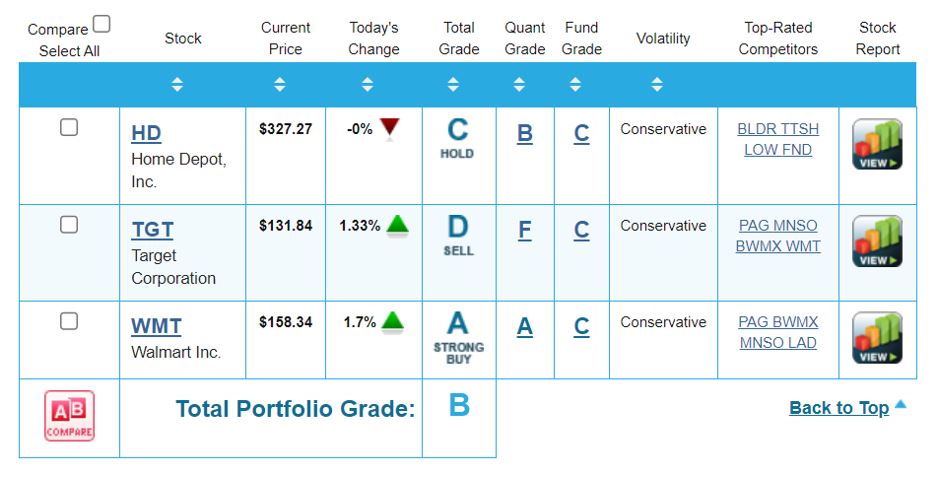

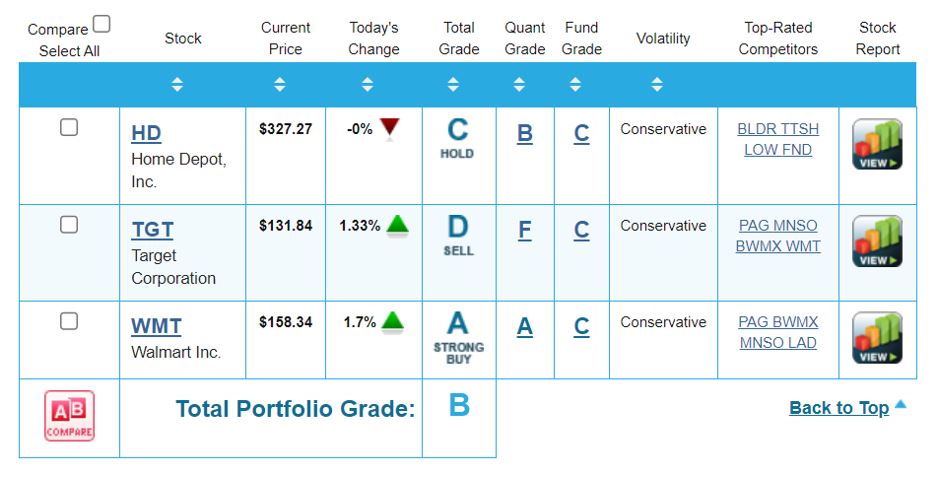

As you can see from the report card above, while Walmart has an A-Rating, making it a “Buy,” Home Depot has a C-Rating, making it a “Hold,” and Target has a D-Rating, making it a “Sell.”

Well, then what stocks are good buys right now?

The answer is simple: Those with superior fundamentals that are highly rated by my AI Mastermind system.

If you’re looking to invest in stocks with superior fundamentals, my AI Mastermind system can help make sure your portfolio is packed with the right stocks.

My proprietary AI Mastermind system tracks more than 6,000 stocks and determines whether or not they are good buys by focusing on eight precursors that can predict the likelihood of what a company’s future earnings can be.

It also measures a stock’s institutional buying pressure, which is how much big institutional investors, like pension funds and Wall Street banks, are piling in… or pulling out. The more money that floods into a stock, the more momentum a stock has to rise. The opposite is also true: The more money that flees a stock, the more momentum a stock has to fall.

To learn more about my AI Mastermind system – and how you can use it to find the best stocks in any sector – click here. Sincerely, |

.png)

.png)

No comments:

Post a Comment