The Latest Inflation Report Disappoints – but There Are Still Ways to Profit Dear Reader, We got mixed results this week from our two main inflation reports – the Consumer Price Index (CPI) and Producer Price Index (PPI) – for July. While economists deemed the CPI positive, the PPI reading was a bit problematic.

Ahead of the PPI reading, I predicted that it would be negative for July… because of China. That nation’s annual producer price inflation has been negative for nine-straight months and declined 5.4% in June, which was the lowest level since December 2015. It followed up June with a 4.4% year-over-year decline in July.

Economists only expected a 4.1% drop.

It’s important to note that consumer inflation China is also negative. Consumer prices in China dipped 0.3% year-over-year in July, marking the first decline in consumer inflation since February 2021. So, in addition to the recent collapse in imports and exports (down 12.4% and 14.5%, respectively, in July), China now has deflation on the wholesale and consumer levels.

And China’s deflationary environment isn’t contained within its borders. It’s spreading. The primary reason that U.S. wholesale goods fell 4.4% in the past 12 months through June was lower import prices from China, as well as other Asian countries.

The U.S. is now importing deflation from China and other Asian countries, so it made sense that PPI would dip in July.

That clearly wasn’t the case. And so, in today’s Market 360, we’ll reveal the real reason why the PPI disappointed this week. We’ll also review the CPI numbers, and I’ll explain why the latest inflation data is so important.

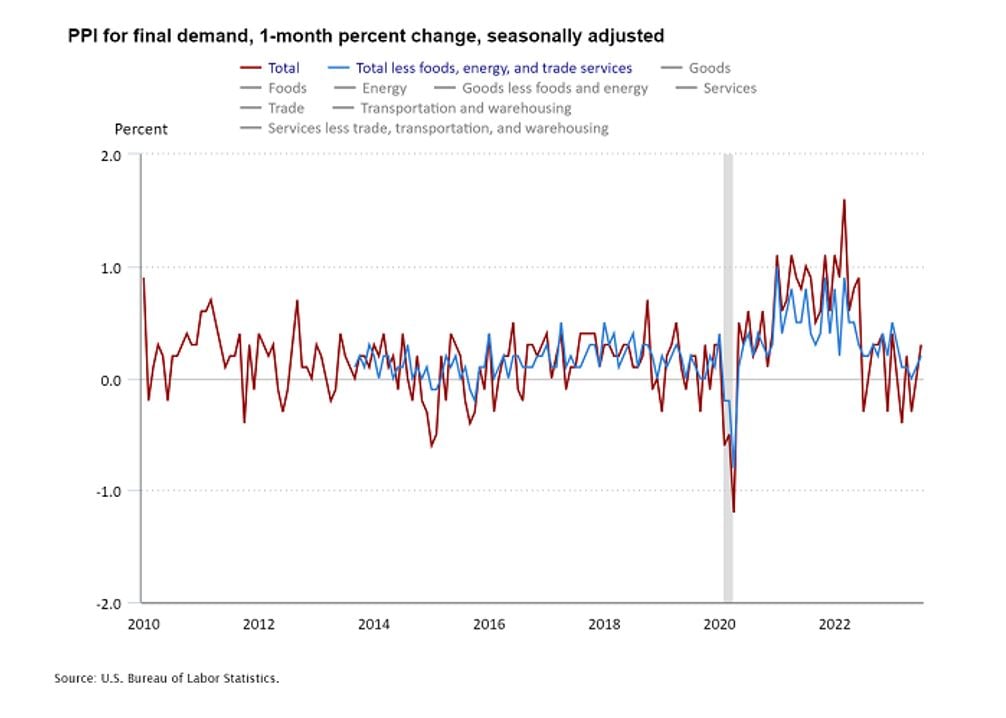

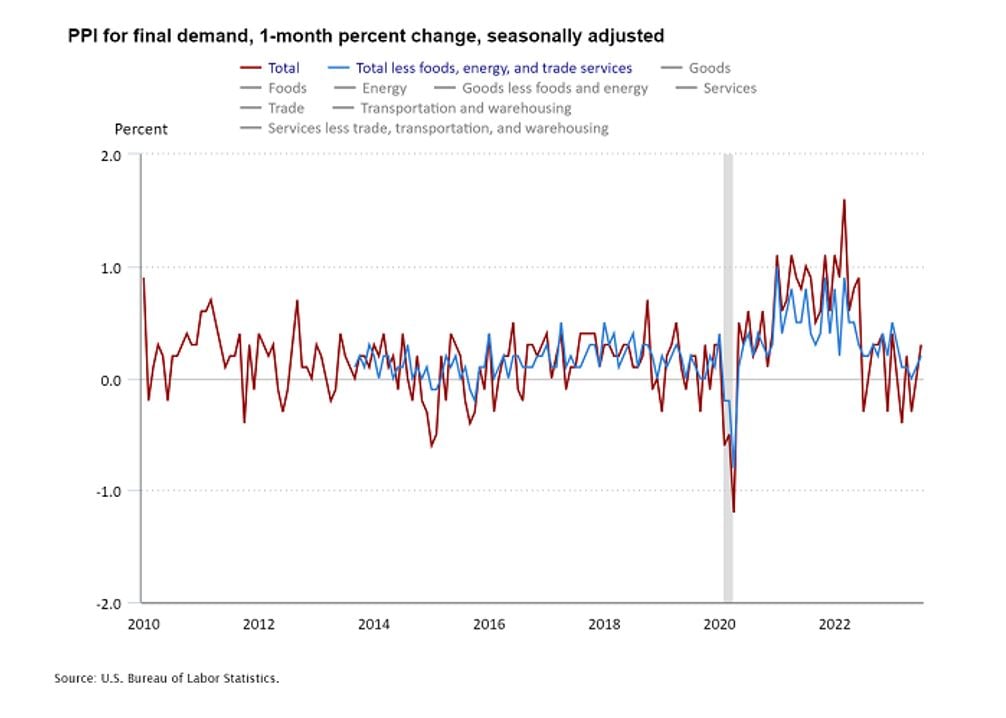

And then, I’ll share how you can best profit in this inflationary environment. Producer Price Index On Friday, the Labor Department reported that the PPI, which measures wholesale inflation, rose 0.3% in July and 0.8% in the past 12 months. Core PPI, which excludes food and energy, rose 0.3% in July and 2.4% in the past 12 months. You can see that in the chart below.

I was hoping wholesale goods prices would be low, but instead they increased 0.1% after being negative on a 12-month basis through June.

There were some other interesting details in the PPI report, like wholesale food prices rising 0.5%. Transportation and warehousing costs increased 0.5%, and trade services were up 0.7%. But what I found most surprising was that energy prices only rose 0.1% despite the higher gas prices. This was because of a 7.1% drop in wholesale diesel prices.

Now, the real culprit behind the jump in the PPI were wholesale costs, which rose 0.5%. I dug into the details of the service cost increase, and believe it or not, it was the stock market’s fault!

Portfolio management fees went up 7.6% in July, due largely to the fact that the stock market rose in the second quarter and portfolio management fees tend to be billed in advance based on the last quarter. I think that’s a silly reason for wholesale service costs to go up.

The bottom line: This was a very disappointing PPI because inflation is reaccelerating on the wholesale level.

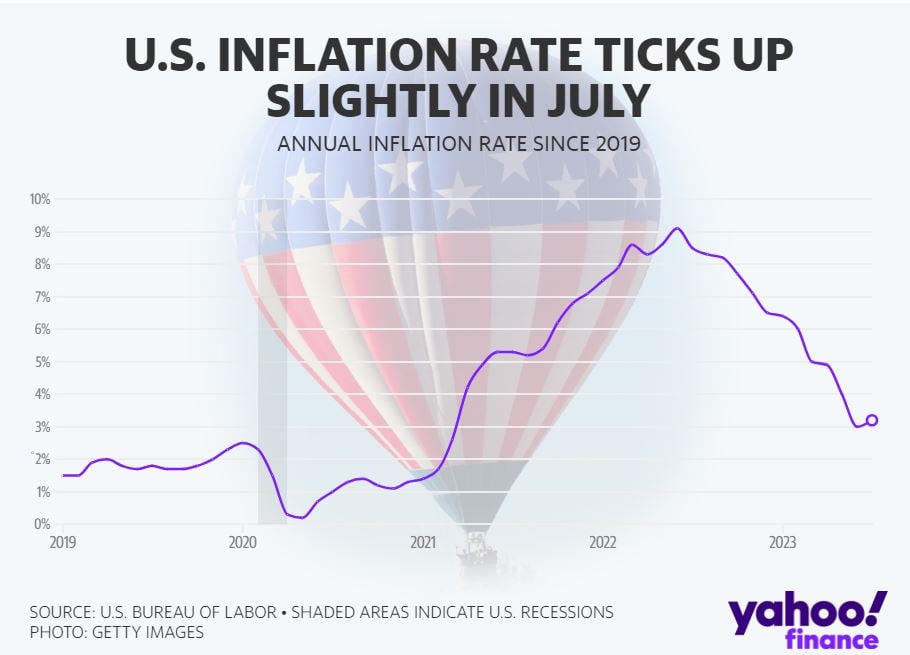

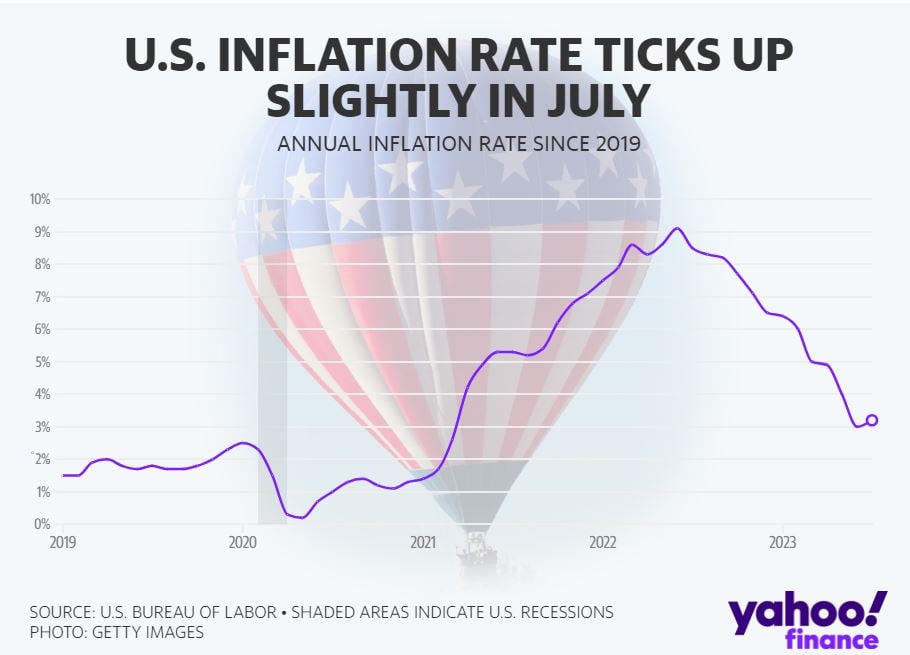

The silver lining is that it’s still running under 1%, and I expect that the U.S. will import inflation from Asia. The sooner that happens, the sooner key interest rates can come down. Consumer Price Index On Thursday, the Bureau of Labor Statistics announced that the CPI, which measures consumer inflation, rose 0.2% in July and 3.2% in the past 12 months. This was slightly lower than the expected 3.3%.

Core CPI, which excludes food and energy, also rose 0.2% for the month and 4.7% in the past 12 months. That was in line with economists’ expectations. It also marks the smallest increase at an annualized rate since October 2021.

Digging a little deeper into the numbers, we learn that food prices rose 0.2% in July. And energy prices increased 0.1%, even though gasoline prices rose 0.2% and natural gas prices rose 2%.

The sticky point within the CPI report was the Owners’ Equivalent Rent (OER). OER rose 0.49% and shelter costs rose 0.4%, accounting for 90% of the July CPI increase. Although OER is running cooler than just a few months ago, it rose slightly in July compared to June’s 0.45% increase.

Overall, the core CPI has risen at an annualized rate of 3.1% in the past three months, which is the slowest pace since March 2021. So, consumer inflation is still moderating and will move significantly lower as soon as OER and shelter costs cool off in the upcoming months. Why the Inflation Data Is Important At the last Federal Open Market Committee (FOMC) meeting, the Fed stated it would “continue to take a data-dependent approach in determining the extent of additional policy firming that may be appropriate.”

That data includes the latest consumer and wholesale inflation reports. Considering that inflation remains low on both levels, and the fact that deflation is spreading, it is growing even more likely that global central banks will halt their key interest rate policies. Specifically, I think the Fed will “pause” again at its upcoming September meeting, with the market already pricing in a 90.5% chance that the Fed will stand pat next month. A pause in key interest rate hikes would be very good news for overall economic growth. Right now, the Atlanta Fed anticipates the U.S. economy will grow at a 4.1% annual pace in the third quarter. That’s up from its initial forecast for 3.5% GDP growth at the end of July.

Hopefully, though, July’s CPI and PPI readings are low enough for the Fed to hit the pause button again in September. Profiting in an Inflationary Environment But until inflation really tamps down, your best bet for profits are in fundamentally superior stocks because we remain in a fundamentally focused market environment as investors continue to chase after companies that can consistently grow their sales and earnings… like my Growth Investor stocks.

For example, shares of Axon Enterprise, Inc. (AXON), which is primarily known for developing the TASER, surged more than 15% on Wednesday after reporting second-quarter earnings Tuesday evening that crushed analysts’ estimates by 79%.

Overall, my Growth Investor stocks are characterized by 11.3% average annual sales growth and 172.3% average annual earnings growth. The analyst community has also upped their earnings estimates by an average 5.8% in the past three months – and as of last Friday, my Growth Investor stocks have an average earnings surprise of 18%.

Compare that to the S&P 500’s average earnings surprise of 7.2%.

If you want to make money right now, then you want to be investing in companies that post strong earnings and sales. If you’re not sure where to look, then start with my Growth InvestorBuy List, as these stocks fit the bill.

So, join me today to gain full access to my Growth Investor Buy Lists, as well as all my Monthly Issues, Weekly Updates, Special Market Podcasts and Special Reports.

Click here to become a member now. Sincerely, |

.png)

.png)

No comments:

Post a Comment