When Should You Buy Back In?

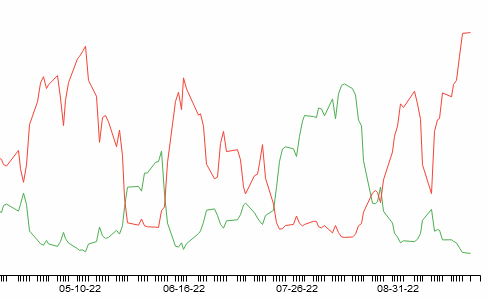

The S&P 500 Index is down roughly -22% so far this year. The tech-heavy Nasdaq Composite Index is doing even worse. It's down around -32%. But as bad as it seems right now, the stock market is still the best game in town to grow your wealth, if you know how and when to buy in. Now, I would love to run headfirst back into stocks. I'm guessing most folks would, too. But I'm waiting for a signal. And not just any signal, either. Let me explain... You see, a few "up" days – or even a couple "up" months – in the middle of a bear market can play with your emotions. It might feel like stocks have finally turned the corner, only to get spanked all over again. But don't get caught up in the euphoria. The "fear of missing out" is very dangerous. It could lead you to chase returns that might never happen, or worse, it could lead to losses. Find out what needs to change with this indicator in order to go all in.

These are still very exciting times to be investing in stocks. You DO NOT want to miss this. The time to prepare for a market turn in NOW! Thank you,

Copyright 2022 *$2.4 million in 18 months, $15 million in 12 years are some of the very best results this method has ever achieved and are not typical. Investing is Inherently Risky - There are risks inherent in all investments, which may make such investments unsuitable for certain persons. These include, for example, economic, political, currency exchange, rate fluctuations, and limited availability of information on international securities. You may lose all of your money trading and investing. Do NOT enter any trade without fully understanding the worst-case scenarios of that trade. And do NOT trade with money you cannot afford to lose. Past performance of an investment is not necessarily indicative of its future results. No assurance can be given that any implied recommendation will be profitable or will not be subject to losses. If you no longer wish to receive these emails you can unsubscribe below. |

| This email was sent to phanxuanhoa60.trade1357@blogger.com. Don't want to receive these emails anymore? Unsubscribe |

| TradersPro (Investiv, LLC), 265 N. Main, Ste. D #283 Kaysville UT 84037 |

No comments:

Post a Comment