More Articles | Free Reports | Premium Services By Keith Kaplan, CEO, TradeSmith Never catch a falling knife… Everyone knows that. Equally, never buy a stock while it’s plunging. You’re more likely to get hurt than to succeed. That is, unless you do it with the right strategy. If you buy the right stocks… at the right time… it can be highly lucrative. A couple of months back, my TradeSmith team and I got the idea to design a system that’s like wearing Kevlar gloves so you can catch a falling knife… We tested countless variables until we eventually found the one combination that produces a rare but reliable trading signal. We call it the Snapback Strategy. By targeting quality stocks in sudden, steep downtrends, we found you can profit from the ensuing snapback. As I’ll show you today, it produced a win rate of 79.59% over 10 years of backtesting. And the average return across the 338 trades it flagged over that time – winners and losers – was 15.83%. With Nvidia, Palantir, and other AI stocks in selloff mode this week, it’s exactly the kind of system you want on your side right now. So let’s discuss those Kevlar gloves… Never Catch a Falling Knife – Unless You’ve Got Kevlar Gloves On Setups from our new strategy don’t happen often. They rarely happen in stocks with a low Volatility Quotient (VQ). The VQ is TradeSmith’s measure of a stock’s volatility. The higher the score, the more dramatic its price swings tend to be. Lower scores mean a steadier stock. That makes sense. High-quality stocks don’t tend to make big drops. The market rewards great businesses with higher share prices. But every so often, a poor earnings report, or a shock event, can cause even high-quality stocks to plummet. That’s when you want to buy. Only, make sure you’re wearing those kevlar gloves when you do. I can’t share with you the exact parameters of this strategy. If I did, anyone could trade it. That wouldn’t be fair to TradeSmith’s paying subscribers. But I can show you some of the best performers our strategy spotted in backtesting. The first was a setup in health insurer Humana (HUM) during the pandemic crash. On March 23, 2020, the Snapback Strategy signal triggered on HUM at $206. Buying it then and holding for the next 21 trading days probably sounded like a horrible idea at the time. But… | Recommended Link | | | | Investing legend Louis Navellier warned us about the stock market crash of 1987... the 2000 dot-com crash… Enron’s collapse… and the 2008 financial crisis crash. He also predicted the rise of a host of iconic stocks… including Google, Apple, Amazon, Netflix, Facebook, and Nvidia. Today, he’s stepping forward to make history yet again… with a critical market forecast he’s calling: “My biggest prediction in 47 years…” Click here to see it. |  | | The Power of Snapbacks Had you traded the Snapback Strategy signal on March 15, you’d have walked away with a 72% return as the stock shot back up to $355.

Now, let’s look at a more isolated incident involving insurance company Globe Life (GL) from last year. Globe Life was the target of a short report that accused it of insurance fraud. Its stock dropped more than 50% in a single session. And that was enough to trigger the signal on April 15 at a price of $55. Twenty-one trading days later, the stock recovered to $88. Had you followed the snapback signal, you would have bagged a 59% gain.

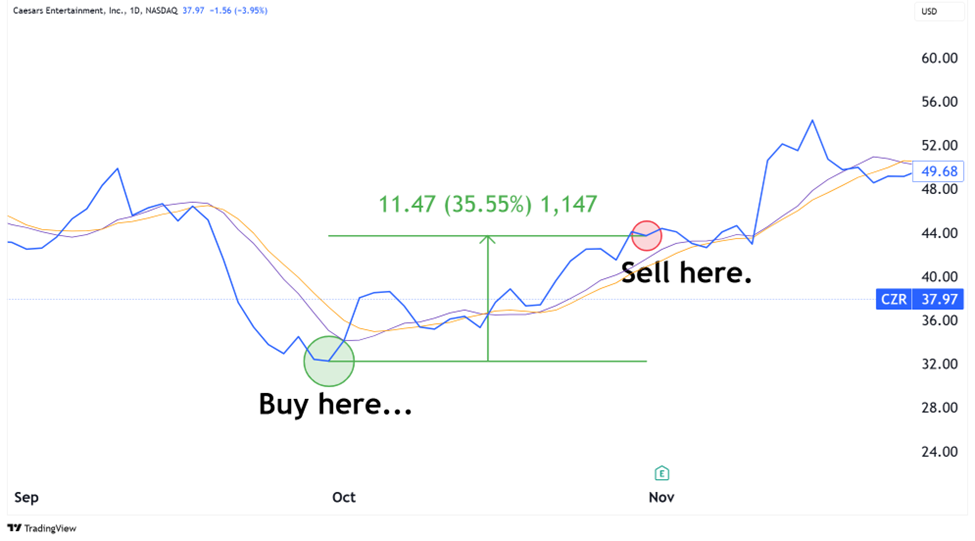

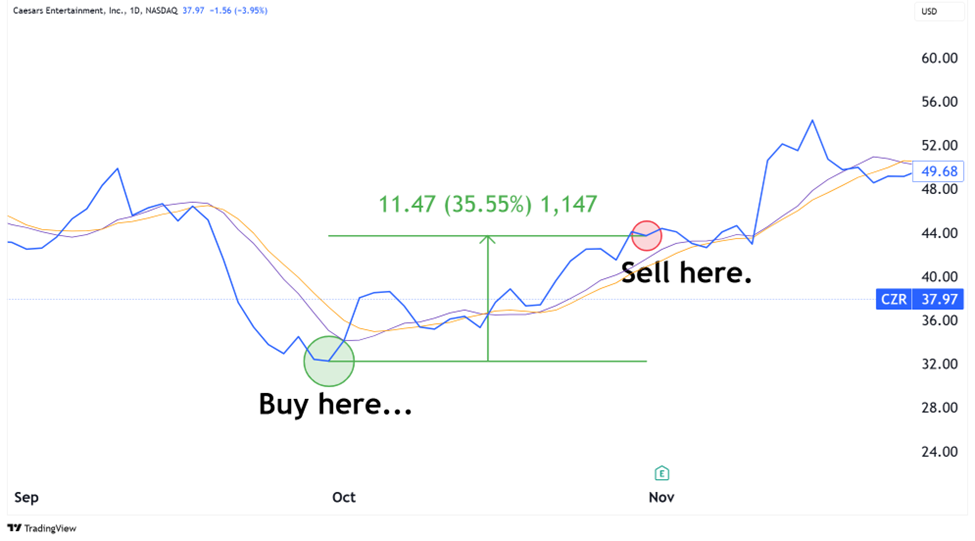

Then there’s one of the cleanest examples I’ve found. It’s a setup from 2022 in casino stock Caesars Entertainment (CZR). On September 30, 2022, the signal triggered at $32.36. Had you bought then, and sold 21 trading days later, it would’ve led to a 35.5%.

To be clear, there were losers, too. But like I said, in our backtesting, only one in five of our Snapback Strategy signals would have lost you money. So, this strategy drastically puts the odds of success in your favor. That’s why we’re rolling it out to our elite-level subscribers. When we integrate it into TradeSmith, they’ll be able to see new entry signals on this strategy and follow these snapback signals. And as I mentioned, this kind of strategy is particularly important to have on your side right now. | Recommended Link | | | | As the markets recoil from looming trade wars, global instability, and sticky inflation… an ultra-rare pattern not seen for 29 years has emerged. Does this pattern signal more despair for investors… or perhaps a remarkable opportunity to get ahead despite the volatility? Don't miss the details at our special briefing tomorrow, February 27th. Reserve your spot now. |  | | AI Darlings Are Leading the Rout We’ve seen a sharp pullback in tech stocks this week. AI darlings have been leading the rout. For instance, over the past five trading days, AI chipmaker Nvidia is down about 10%... …Palantir Technologies, a firm that uses AI to analyze vast data sets, is down 29%... And chipmaker Broadcom is down about 11%. So, I hope you’ve got time to attend the free research demo I’ll be leading tomorrow at 8 p.m. ET. During this demo, I’ll… -

Share more details on the Snapback Strategy tool I showed you today -

Unveil the master algorithm we’ve developed at TradeSmith to identify market melt-ups… and give advanced warnings of meltdowns -

Show how I use this algorithm to tell whether Nvidia is a buy, hold, or sell for 2025. So, if you want to take hunches and gut feelings out of your investing… and rely on cold, hard data instead… it’s going to be eye-opening. I hope you’ll join me. You can sign up, for free, here. All the best, |

ليست هناك تعليقات:

إرسال تعليق